Dollar Drops As Inflation Runs Hot

MFMTeam

Publish date: Thu, 13 Jan 2022, 08:17 AM

STATE OF THE MARKETS

Dollar drops as inflation runs hot. The US Dollar (DXY) dropped to the 95 handle after reports of higher than expected inflation, while major stock averages managed to eke small gains. Dow (+0.11%), S&P (+0.28%) and Nasdaq (+0.23%) closed in green, though the small cap Russell (-0.82%) fell lower. The 30Y yields climbed back to 2.10%, while the 10Y to 1.75% and the shorter 2Y to 0.93% as investors expect higher rates from the Feds soon.

In the commodities market, crude continues its upward trajectory to $82.45/bl as EIA reports show higher consumptions with the bigger inventories drop. Higher inflation fixed gold higher to past $1,825.70/oz while iron ore past $128.60/tn.

In the FX space, King Dollar was dumped across the board as investors and short term traders ran for higher beta Aussie, Kiwi and Loonie. On Thursday, markets look forward to seeing the latest earnings report from Taiwan Semiconductor (TSM), Delta Airlines (DAL) and Washington Federal (WAFD) as well as unemployment claims and producer price index to gauge the state of the US economy.

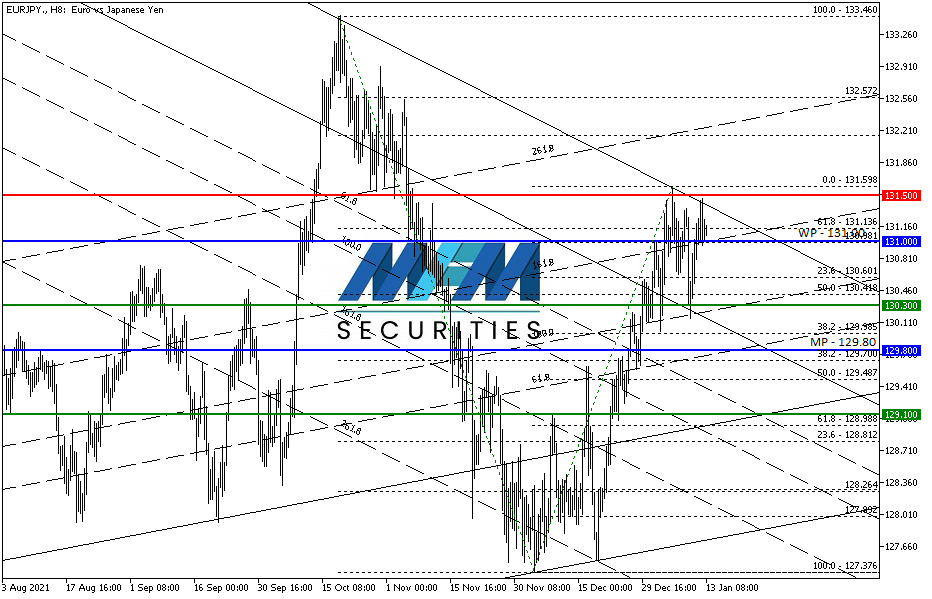

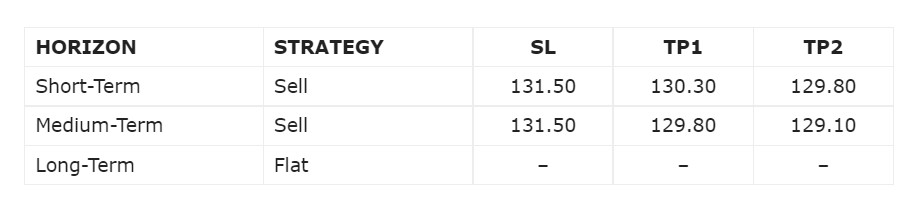

OUR PICK – EUR/JPY

We stay put. Seeing three days in a row of EUR/JPY trades in total of over $200m, we decided to stick with these shorts and re-enter if stop loss was filled. With Japanese tax seasons coming soon, we expect Yen to gain strength in the weeks to come. May use open TP on partial orders to maximize gains. However, any close above the ¥131.50 on the daily would negate the bearish scenario.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.