Stocks Dive Further Amid Risk Off

MFMTeam

Publish date: Thu, 20 Jan 2022, 08:23 AM

STATE OF THE MARKETS

Stocks dive further amid risk off. US stocks took another dip on Wednesday as inflation fears rattle markets and sent precious metals higher. Dow (-0.96%), Nasdaq (-1.15%), and S&P (-0.97%) including Russell (-1.60%) lost ground amid risk-off that sent yields lower and silver with gold higher as investors fled to safety. The 10Y yields almost pierced 1.90% before settling around 1.85% as bids swooped in.

In the commodities market, crude was under pressure as profit taking continued and the black gold settled around $84.88/bl as New York closed. Fears of inflation and coming rate hike spiked gold up to $1,843.24/oz and with silver at $24.10/oz as another commodity, iron ore sky rocketed to $130.58/tn

In the FX space, risk-off was affecting medium term accounts more than anything else as Yen and Swiss reigned in the demand territories with Loonie and Dollar. Short and long term accounts however look slightly bullish as more demand for Aussie emerged while gold climbed higher.

On Wednesday, markets look forward to seeing the latest earnings report from Netflix (NFLX), Union Pacific (UNP), Intuitive Surgical (ISRG), CSX Corp (CSX) and Travelers (TRV) as well as unemployment claims to gauge the US labor market.

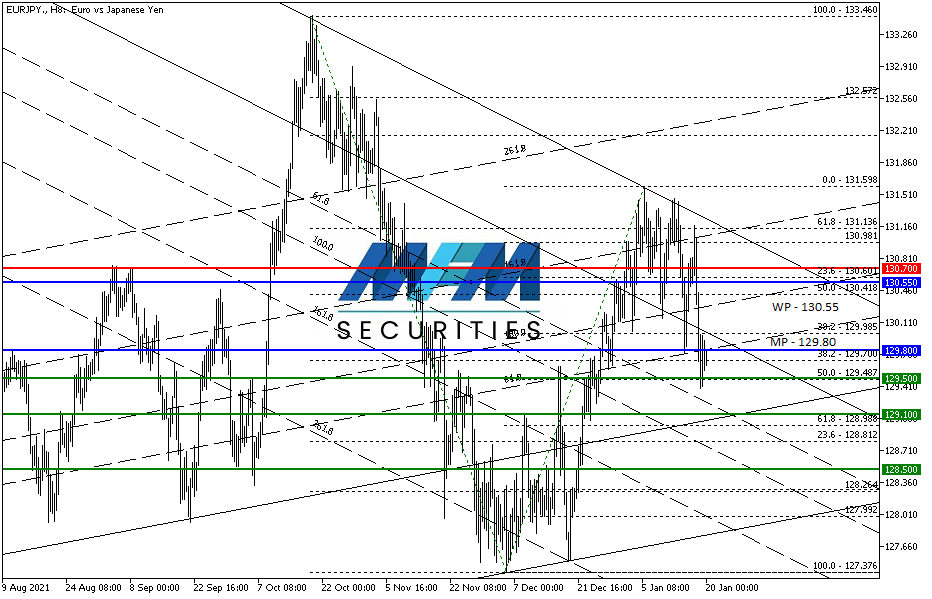

OUR PICK – EUR/JPY

Re-entry on block orders. After reaching medium term TP1, we see follow through in block orders and further strength in Yen as risk off continues and Japanese tax season is here. Stop revised lower to ¥130.70 with new targets and any close above ¥130.25 on the daily would negate this bearish scenario.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.