Stocks Rebound Sharply On Negative Breadth

MFMTeam

Publish date: Tue, 25 Jan 2022, 08:08 AM

STATE OF THE MARKETS

Stocks rebound sharply on negative breadth. US stocks rebounded sharply on Monday after an early sell-off, but remained on negative breadth. Dow (+0.29%), Nasdaq (+0.63%), S&P (+0.28%) and Russell (+2.29%) finished higher with declining counters beating advancing counters by 1.3 on the NYSE and 1.1 on the NASDAQ. Dollar and yields rebound simultaneously with DXY spiked to 96.15 as the 10Y reached 178 basis points.

In the commodities market, crude closed lower around $83.88/bl as traders continue on profit taking for the month. Gold was fixed higher around $1,842.65/oz ahead of the FOMC meeting on Wednesday, signaling more confirmation of Fed’s stance on the interest rates. Elsewhere, iron ore was little changed at around $129.50/tn after receiving bids at $127.50/tn on Friday.

In the FX space, long term sentiments turned more bearish as Swiss and Yen advanced further into demand, while high beta Aussie and Kiwi retreated to offers. Short and medium term traders seemed to capitalize on the overbought safe-haven to get into the Euro while dumping the Loonie.

On Tuesday, markets look for earnings reports from American Express (AXP), General Electric (GE), Johnson & Johnson (JNJ), Lockheed Martin (LMT) Raytheon (RTX), Nextera Energy (NEP), Microsoft (MSFT) and Verizon (VZ) as well as consumer confidence and FHFA home price index.

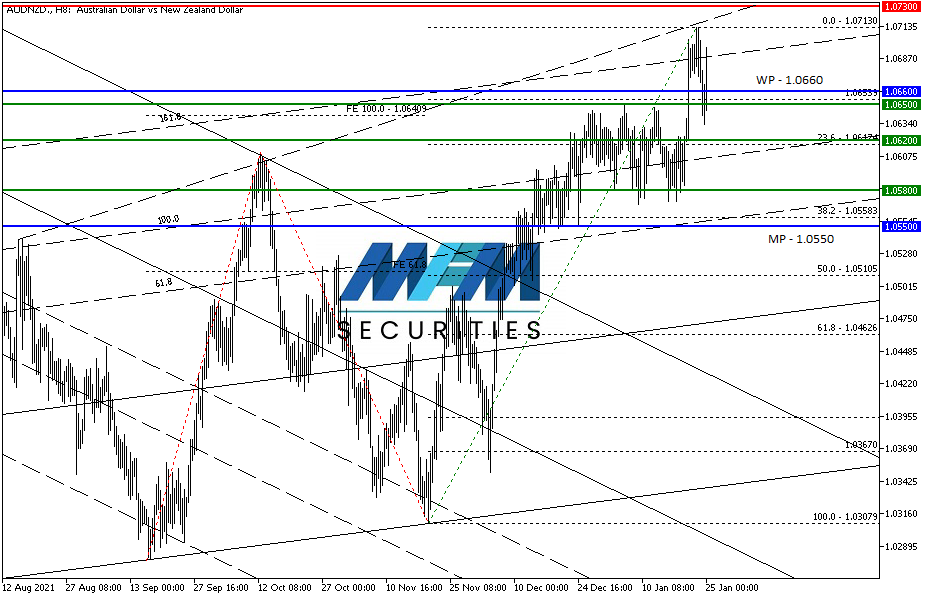

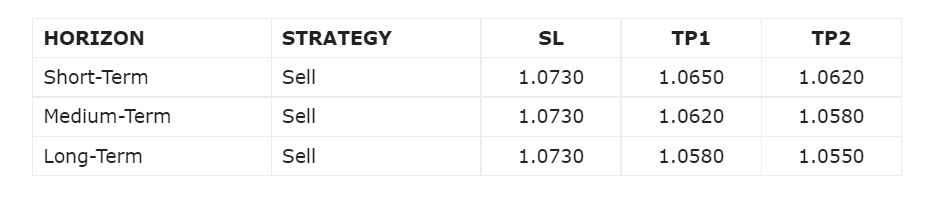

OUR PICK – AUD/NZD

Right time for yields. There is no doubt that NZ bond yields offer more than most of the G8, but timing is everything to benefit from the best exchange rate. We see Kiwi demand to exceed Aussie in the weeks to come as the pair now test 61.8 monthly retracement, circa 1.0690. Further rebound to test monthly downtrend line, circa 1.0780-1.0800, can’t be ruled out however. Closed below 1.0680 on the daily confirmed that bears are in charge.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.