Stocks Mixed On Safe-Haven Flows

MFMTeam

Publish date: Tue, 08 Feb 2022, 08:17 AM

STATE OF THE MARKETS

Stocks mixed on safe-haven. US stocks closed mixed on Monday as investors seek safety in bonds and safe-haven assets. Nasdaq (-0.58%) and S&P (-0.37%) were in the red, while Russell (+0.51%) edged higher as Dow was unchanged. Dollar index was stalled at 95.50 minor handle as demands for shorter term US treasuries sent yields lower. The 2Y fell to 1.29% while the 5Y to 1.77% as the 10Y inched higher to 1.92% and the 30Y to 2.22%.

In the commodities market, crude climbed higher to $90.50/bl as winter storms hit the US forcing refineries to shut down amid higher demand. Safe haven demands sent gold higher past $1820.10/oz as inflation worries continue to plague markets. Elsewhere, iron ore is stalled near $146/tn as investors wait for the next catalysts in the US BBB plan.

In the FX space, Euro continues to reign in the medium and long term demands while ousted to offers with Dollar, Swiss and Sterling in the short term. It seems that short term traders are selling the overbought currencies while buying the oversolds.

On Tuesday, markets look for earnings reports from Pfizer (PFE), BP PLC (BP), S&P Global (SPGI), Dupont (DD), KKR & Co (KKR) and Chipotle (CMG) as well as the latest US trade balance.

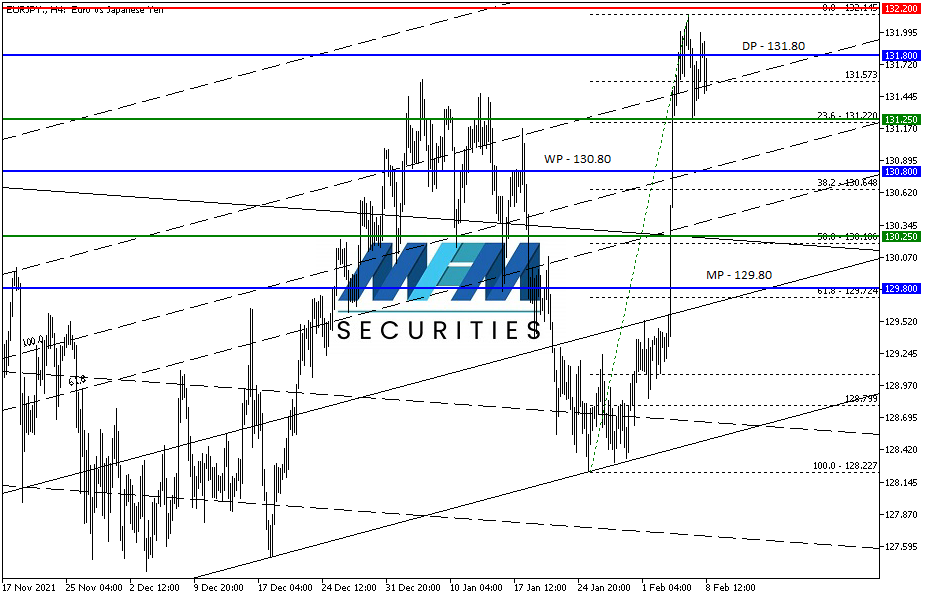

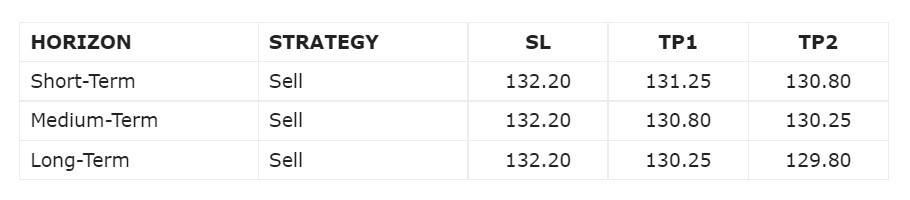

OUR PICK – EUR/JPY

ECB to cool off rate hike expectations. ECB’s Lagarde on Monday appeared more cautious on rate hike and pointed to no need for big monetary policy tightening as inflation is set to fall back and could stabilize around 2%. The comment has sent Euro on offers and with safe haven flows, we expect EUR/JPY to pull back to pre-hawkish comment last Thursday, circa ¥129.50.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.