Strong Earnings Pushed Stocks Higher

MFMTeam

Publish date: Thu, 10 Feb 2022, 08:20 AM

STATE OF THE MARKETS

Strong earnings pushed stocks higher. US stocks continue its upward trajectory for the second day after a series of strong earnings releases hit the news wires. Dow (+0.86%), Nasdaq (+2.08%), and S&P (+1.45%) including Russell (+1.86%) broke resistance as the Dollar index stalled around the 95.50 mark. Shorter term 2Y (1.37%) and 5Y (1.82%) yields climbed higher while the longer term 10Y (1.95%) and 30Y (2.25%) were little changed.

In the commodities market, crude edged higher after EIA reports of reduced inventories. The black gold settled near $89/bl as New York closed. Gold continues to receive strong bids ahead of the inflation report on Thursday that sent the precious metal past $1835/oz. Elsewhere, iron ore pulled back to $148.80/tn as investors took profits off the table.

In the FX space, strong bids were noted for the Loonie that pushed the commodity currency into the demand territories across all horizons. Overall sentiments were bullish as the safe-haven Swiss, Yen and Dollar were pushed back to the offered territories.

On Thursday, markets look for earnings reports from Coca Cola (KO), AstraZeneca (AZN), Philip Morris (PM), Linda PLC (LIN), Duke Energy (DUK), Cloud Flare (NET) and Verisign (VRSN) as well as the latest US jobless claims and the very much awaited inflation numbers.

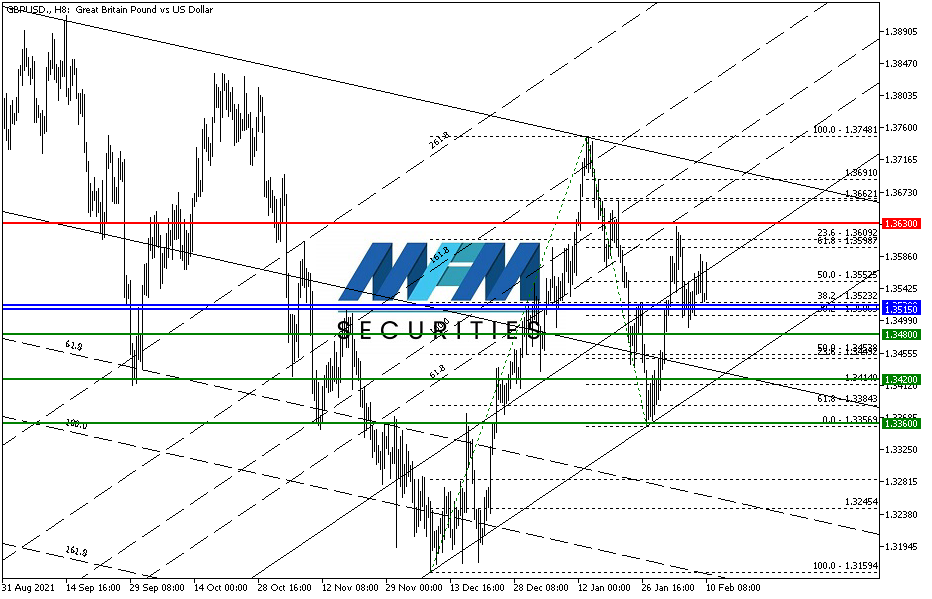

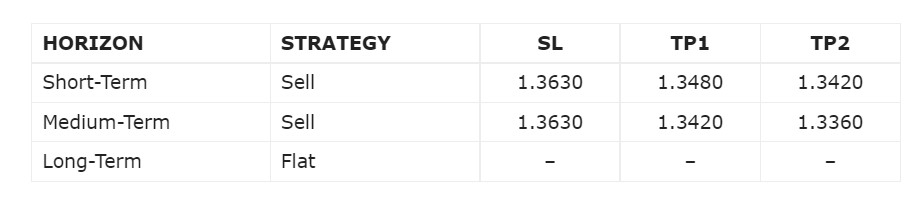

OUR PICK – GBP/USD

Political uncertainty and yield differential may suppress Sterling. The Partygate scandal in the UK has caused uncertainty in the PM Johnson cabinet. Minutes of the last MPC meeting also showed deep divisions within the committee and yields differentials now favored USD by about 46 basis points. UK 10Y gilts stands around 1.496% while US 10Y treasuries at 1.959% and all this may suppress Sterling in the medium term.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.