Dollar Slipped As Tension Eases

MFMTeam

Publish date: Wed, 16 Feb 2022, 08:29 AM

STATE OF THE MARKETS

Dollar slipped as tension eases. US stocks rebound on Wednesday after reports of easing in the Russia-Ukraine conflict, sending the Dollar lower and yields higher. Dow (+1.21%), Nasdaq (+2.47%), and S&P (+1.58%) including Russell (+2.76%) closed in the green as funds flowed out of bonds. The 10Y benchmark fell in price, sending yields higher to 2.04% as the Dollar pulled back to the 96 major handle.

In the commodities market, the easing tension sent major commodities lower. Crude settled below $90.50/bl as gold dropped below $1,855/oz while iron ore dived lower to $146.80/tn.

In the FX space, the sudden shift in sentiments manifested in more demand for Aussie and Kiwi while safe haven Swiss and Yen fell back to offers in the short and medium term accounts. Long term sentiments were mixed.

On Wednesday, markets look for earnings reports from NVIDIA (NVDA), Cisco (CSCO), Applied Materials (AMAT), Shopify (SHOP), Analog Devices (ADI), Equinix (EQIX), Kraft Heinz (KHC) and DoorDash (DASH) as well as the latest US retail sales and the very much awaited FOMC minutes. EIA petroleum status will be in the spotlight for energy traders.

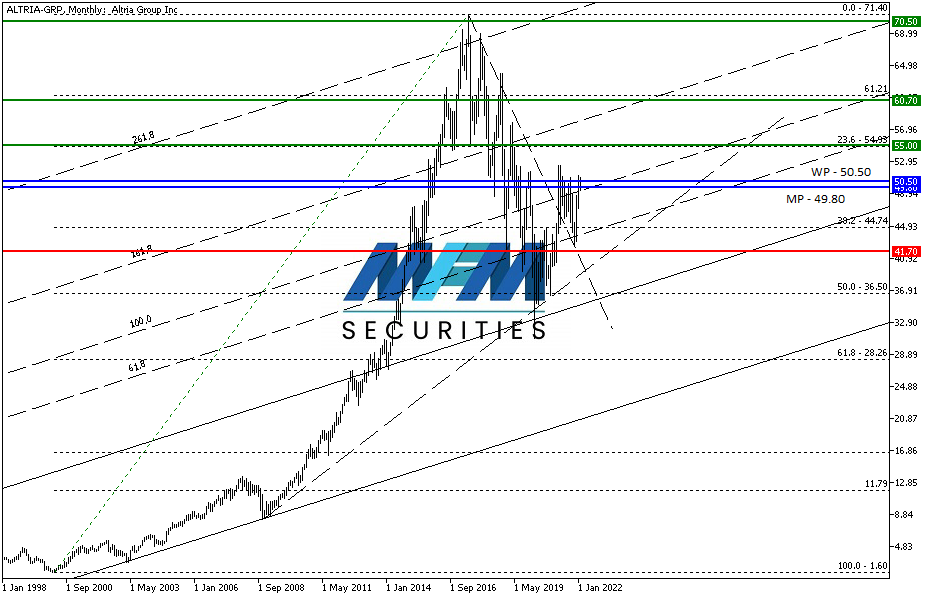

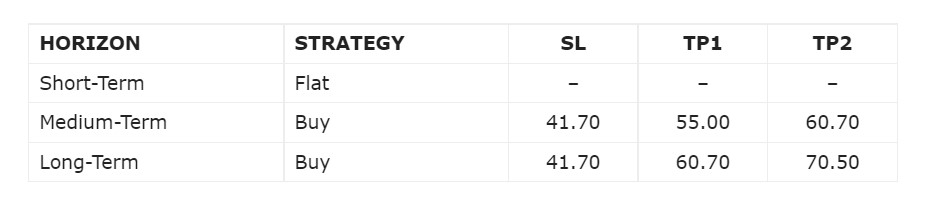

OUR PICK – ALTRIA GROUP (MO, NYSE)

Undervalued with dividends. In the age of inflation, value stocks with dividends will have a long way to go and Altria Group is one of them. Smokers are still going to smoke regardless of all the scary pictures on the cigarette box. With new technology like vapes, this company is going to exist for a very long time. Fairly valued at $60.80/share gave this company a 21% upside with 7.15% dividends yields. We pick this as one of a long term hold in a cash account.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.