Thin Markets Amid US President’s Day

MFMTeam

Publish date: Tue, 22 Feb 2022, 08:26 AM

STATE OF THE MARKETS

Thin markets amid US President’s day. Global equities from FTSE UK (-0.39%) to Nikkei (-0.78%) closed in the red on Monday, while US markets closed for President’s Day. Earlier, Asian markets continued to slide in the wake of Russia’s recognition of the Ukraine separatist republics. Flight to safety was noted in elevated cash demand, with the Dollar index recapturing the 96 handle as the bonds market was closed for the holiday.

In the commodities market, crude continues to rise past $92.20/bl after the Russian announcement on ground of supply disruption. Gold was bid higher, past $1,911.00/oz as demand flourished on geopolitical concerns. Elsewhere, iron ore continues its downward trajectory to $141.10/tn as escalation of war might dampen demand for the commodity.

In the FX space, risk off was evident as safe-haven flows in Swiss, Yen and Dollar dominated the short and long term accounts, while medium term accounts sought to hedge as the month came to an end this week. On Tuesday, markets look for earnings reports from Home Depot (HD), Medtronic (MDT), Public Storage (PSA), Palo Alto Networks (PANM), Macy’s (M), Agilent Tech (A) and APA Corp (APA) as well as the latest figures on the US PMIs and consumer confidence.

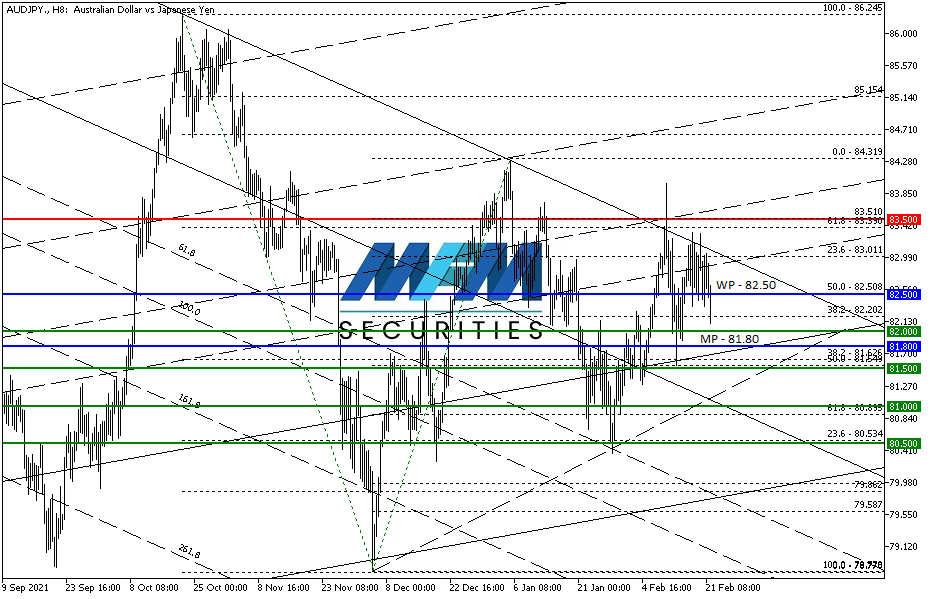

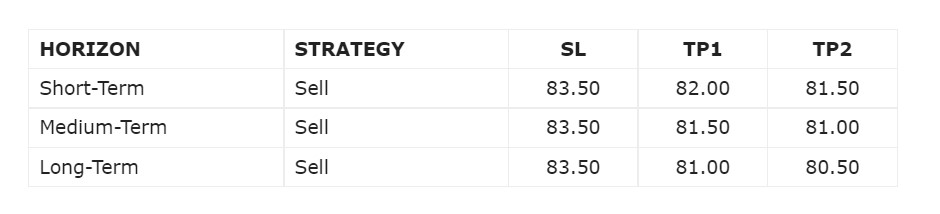

OUR PICK – AUD/JPY

Re-entry on Aussie short via JPY. Our Aussie short thesis remains valid as we have seen further escalation in the Russia-Ukraine tension. Russia will not go to war but instead welcome the separatist republics to the Russian Federation. If this tension escalates further and with RBA’s stance of patience in policy tightening, Yen will garner more bids than Aussie.

For more high probability picks, please use our Trading Central services.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.