Stocks Mixed As Peace Talks Stalled

MFMTeam

Publish date: Tue, 15 Mar 2022, 09:20 AM

STATE OF THE MARKETS

Stocks mixed as peace talks stalled. US stocks closed mixed on Monday after Russia-Ukraine peace talk was stalled amid ongoing Russian offense. Dow was unchanged, while S&P (-0.74%) and Nasdaq (-2.04%) finished the red as investors continue to cash in, sending Dollar back above the 99 handle. The 10Y benchmark continues to climb past 2.15% at writing ahead of the Fed’s meeting on Wednesday.

In the commodities market, a new Iran deal that might increase crude output has sent the black gold back to below $100/bl. Gold was under pressure as profit taking continued and the metal is trading below $1,950/oz at writing. Similarly, iron ore retreated further to $150.10/tn as New York closed.

In the FX space, King Dollar and Euro reign in demand for the short and medium term horizons as Aussie and Kiwi were flipped to offers. Long term accounts, however, remained in bids for the commodity currencies.

On Tuesday, markets hope for new development in the peace talks while waiting for earnings reports from SentinelOne (S), Smartsheet (SMAR), IHS Holding (IHS), Dole PLC (DOLE), Caleres (CAL), and Gohealth (GOCO) as well as the latest figure on the US Producer Price Index.

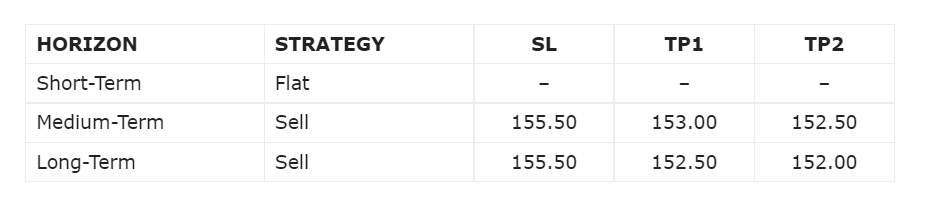

OUR PICK – GBP/JPY

Return of the Yen. Higher mix of inflation and weakening growth outlook amid Russia-Ukraine conflict do not bode well for Europe and specifically the UK and for that we expect Sterling to remain under selling pressure. Risk remains however, that the conflict de-escalate and BoE lift rates more than 25bp this Thursday which would boost Sterling to further upside.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.