Stocks Rallied As Feds Raised Rates

MFMTeam

Publish date: Thu, 17 Mar 2022, 09:24 AM

STATE OF THE MARKETS

Stocks rallied as Feds raised rates. US stocks rallied on Wednesday after the Federal Reserve raised 25 basis points and signaled six more hikes by the end of the year. Dow (+1.55%), S&P (+2.24%) and Nasdaq (+3.77%) including Russell (+3.14%) climbed higher as funds flowed out of safety. Yields from 2Y (1.95%) to 10Y (2.19%) continue to climb, except the 30Y (2.46%) that edged lower on demand as the Dollar index slid to the 98.50 minor handle.

In the commodities market, crude continues to be under pressure after reports of increasing US inventories of more than 4 million barrels. The black gold settled around $93.88/bl as New York closed. Geopolitical risk and inflation concerns continue to support gold as the yellow metal was well bid at the $1,900/oz and settled higher around $1,926.90/oz. Elsewhere, iron ore rebounded to $148.85/tn after bidders emerged to support the commodity.

In the FX space, strong demand for commodities has forced the comdolls to return to the demand territories. Aussie and Kiwi are among the top two leads in the short and long term, while Loonie and Kiwi lead in the medium term. Sentiments appear bullish across the board.

On Thursday, markets hope for progress in the peace talks while looking for earnings reports from Accenture (ACN), FedEx (FDX), Dollar General (DG), GameStop (GME), Commercial Metals (CMC), Lithium Americas (LAC), Canadian Solar (CSIQ) and Signet Jewelers (SIG) as well as the latest US jobless claims, productivity and costs figures to assess the health of the US economy.

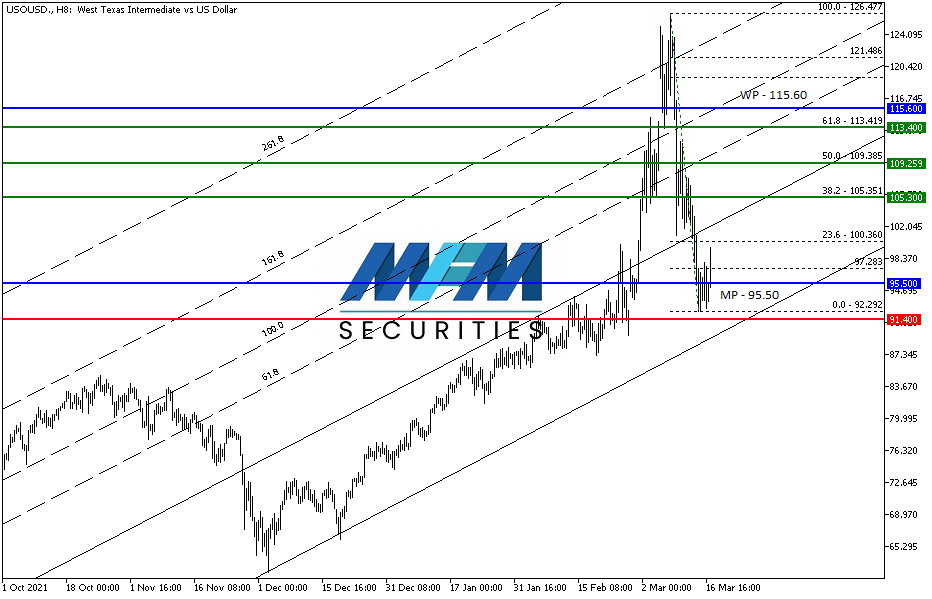

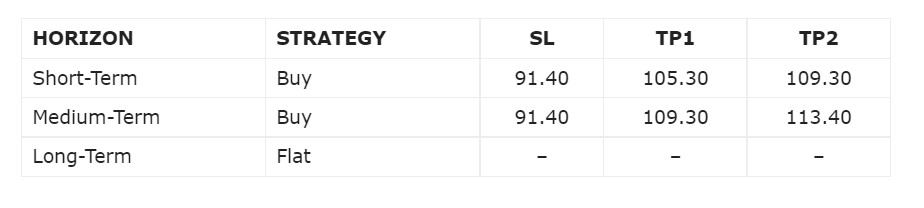

OUR PICK – Crude Oil

Crude is testing pre-Russia-Ukraine conflict. Recent short of more than $80 million at the $120/bl mark has sent crude spiraling down back to the pre-conflict level of around $95/bl. Rising inventories spiked price down to $92.50/bl but bidders continue to emerge in anticipation of a prolonged conflict. With no end in sight for the Iran deal to be finalized, we expect a short to medium term rally.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.