Yields Advanced Further As Stocks Edged Higher

MFMTeam

Publish date: Wed, 23 Mar 2022, 09:20 AM

STATE OF THE MARKETS

Yields advanced further as stocks edged higher. US stocks climbed higher on Tuesday as bonds sell-off continued, sending yields higher, after the Feds signaled more hikes to come to tame inflation. Dow (+0.74%), Nasdaq (+1.95%) and S&P (+1.13%) including Russell (+1.08%) closed in the green as bond yields of various maturities rose to new yearly highs. The shorter 2Y advanced to 2.17%, 5Y to 2.41% while the longer 10Y to 2.39% and 30Y to 2.60% as the Dollar almost punched the 99 figure.

In the commodities market, major commodities slid lower as markets weigh Fed’s coming hikes and Russia-Ukraine conflict on the global economies. Crude settled lower around $108.27/bl while gold continued flirting with the $1,920/oz barrier. Elsewhere, iron ore settled lower around $149.65/tn as New York closed.

In the FX space, sentiments seemed more bullish as Yen thrusted to offer across all horizons while the comdolls trio remained in the helm of demand alongside Sterling and Dollar. Euro remains under pressure across the board.

On Wednesday, markets look for earnings reports from Cintas Corp (CTAS), General Mills (GIS), Trip.Com (TCOM), KB Home (KBH), HB Fuller (FUL), Clear Secure (YOU) and EVgo Inc (EVGO) as well as the latest figures on the US housing market index and new home sales. The EIA petroleum status report will be in the spotlight for energy traders.

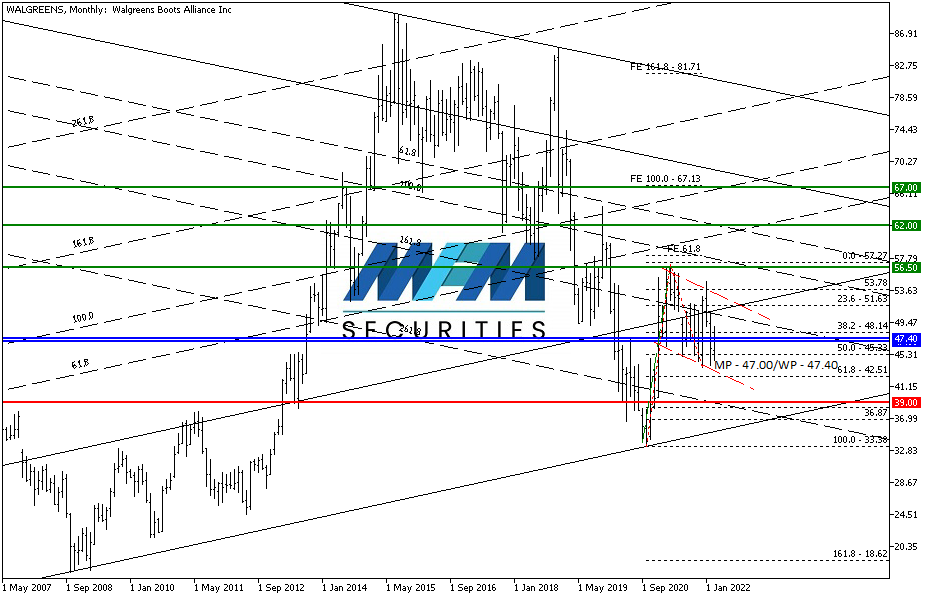

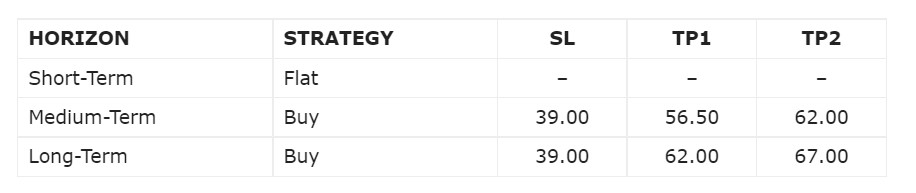

OUR PICK – WALGREENS (WBA, NASDAQ)

Long term inflation proof stocks. A better pick than CVS we believe, given higher yields (4.03% vs 2.05% for CVS) and cheaper valuation (forward PE of 10.1 vs 13.1 for CVS and trailing PE of 6.4 vs 18.2 for CVS). A definite buy in our cash account for long term holding, though risk remains that the stock might test lower bound uptrend channel, circa 40.50 – 42.50, where we would average down our cost. We see a bull flag in the making.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.