Equities Tumbled As Oil Surged

MFMTeam

Publish date: Thu, 24 Mar 2022, 09:21 AM

STATE OF THE MARKETS

Equities tumbled as oil surged. European and US equities tumbled on Wednesday after reports of new sanctions against Russia and Russia demands gas payment in Ruble. FTSE (-0.22%), DAX (-1.31%), Stoxx (-1.01%), Dow (-1.29%), S&P (-1.23%) and Nasdaq (-1.32%) closed in the red while the news sent oil and energy stocks higher. Flight to safety was noted as yields of various maturities fell on bond demands with the 10Y benchmark falling to 2.29% as the Dollar held the 98.50 mark.

In the commodities market, crude pierced $114.80/bl on the news while gold climbed back at testing the $1,950/oz minor handle. Elsewhere, iron ore stalled around $149.65/tn waiting for new catalysts.

In the FX space, long and medium term sentiments were unchanged as short term traders seemed to bid more Swiss and Dollar while offering the Sterling and Loonie.

On Thursday, the Russia-Ukraine war continue to be in the spotlight while markets look for earnings reports from NIO (NIO), Darden (DRI), FactSet (FIS), TD Synnex (SNX), Neogen (NEOG) and KingSoft (DOCU) as well as the latest US jobless claims, productivity and costs figures to assess the health of the US economy.

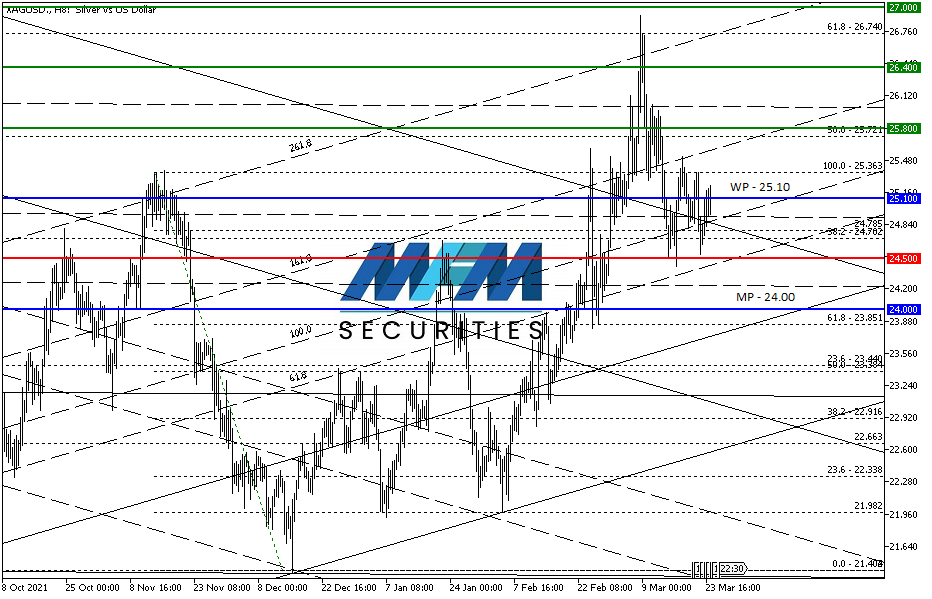

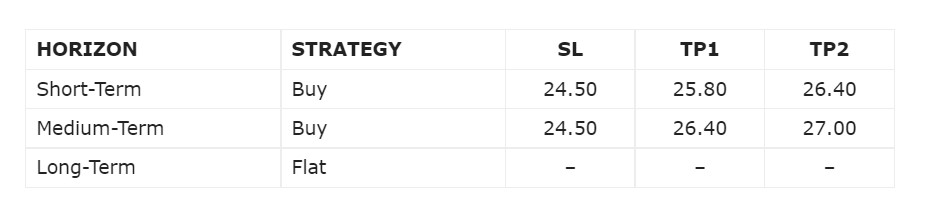

OUR PICK – Re-entry on XAG/USD

Re-entry with a new stop. Block trades orders continue to show strong volume for gold and silver related assets relative to US bonds and bullish Dollar ETF (UUP). Risk remains however that any block orders at 24.80/50 might send the metals lower.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.