Stocks’ Rebound Continues

MFMTeam

Publish date: Tue, 29 Mar 2022, 09:15 AM

STATE OF THE MARKETS

Stocks’ rebound continues. US stocks continue to climb higher on Monday after reports of Turkey brokered peace talk is taking shape in Istanbul. Dow (+0.27%), Nasdaq (+1.31%) and S&P (+0.71%) closed in the green as volatility fell to the lowest level since January. Bonds were sold-off across the board, sending yields higher, with inversion seen between 3Y (2.57%), 5Y (2.56%), 7Y (2.56%) and 10Y (2.47%). Demand for cash was strong as the Dollar index spiked to the 99.37 mark and held above the 99 figure.

In the commodities market, the renewed negotiations between Russia and Ukraine sent crude lower to the last week open of around $103/bl while gold dipped to $1,922.40/oz. Elsewhere, iron ore was holding strong the $150/tn handle despite the lockdown in China’s Tangshan city.

In the FX space, the comdolls trio continue to reign in demand for the medium and long term accounts as the safe-haven Swiss retreated to the offer territories. Yen continues to be sold as sentiments improve.

On Tuesday, markets hope for new development in the Russia-Ukraine peace talk while looking for earnings reports from Micron Tech (MU), Lululemon (LULU), McCormick (MKC), Chewy (CHWY), Cal-Maine Foods (CALM), Miller Knoll (MLKN) and PVH Corp (PVH) as well as the Case-Shiller Home Price Index, consumer confidence and the jobs opening reports.

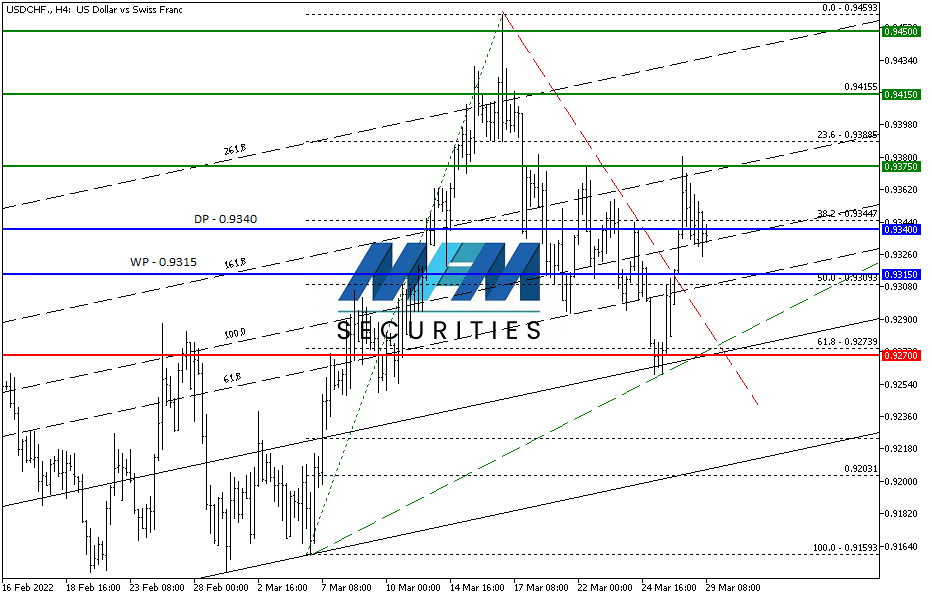

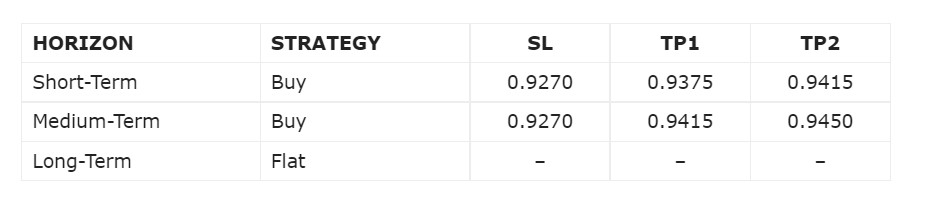

OUR PICK – USD/CHF

Improved sentiments and SNB intervention. SNB sight deposits have increased for the past four weeks suggesting an intervention in the FX markets, buying usually Euro and Dollar. Improved sentiments as the peace talks continue, might also fuel more demand for Dollar than Swiss in the near term. We see buying activity as long as the exchange rate closes above 0.9315 on the daily with 0.9270 stop.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.