Equities Rallied As Peace Talks Progressed

MFMTeam

Publish date: Wed, 30 Mar 2022, 09:32 AM

STATE OF THE MARKETS

Equities rallied as peace talks progressed. Global equities rallied on Tuesday after news of progress in the Russia-Ukraine peace talks in Turkey. FTSE (+0.86%), DAX (+2.79%), Stoxx (+1.74%), Dow (+0.97%), S&P (+1.23%) and Nasdaq (+1.84%) climbed higher. Flight to safety was noted as yields of 5Y (2.49%), 7Y (2.48%), 10Y (2.39%) and 30Y (2.49%) fell lower, while the shorter 2Y (2.36%) edged higher. We noted that the 2Y and 10Y spread is getting closer to inversion. The Dollar was sold off and closed below the 98.50 minor handle.

In the commodities market, crude rebounded to close higher, above $104.30/bl, after news of Saudi’s hiking oil futures while gold dived to the lows of $1,890/oz before finding bidders to closed higher, above $1,919/oz, as inflation remains a concern amid Fed’s behind the curve. Elsewhere, iron ore inched higher to $150.15/tn as bidders continue to defend the commodity.

In the FX space, short term traders managed to swing Euro, Yen and Swiss to the demand territories while ousting Aussie, Loonie and King Dollar to offers. In the medium term, King Dollar lost bids to the Euro and Swiss while long term investors remained on hold.

On Wednesday, the peace talks will continue to be in the spotlight while markets look for earnings reports from Paychex (PAYX), BioNTech (BNTX), UiPath (PATH), AerCap (AER) and Five Below (FIVE) as well as the latest number on US GDP and ADP private employment. EIA petroleum status will be in the spotlight for energy traders.

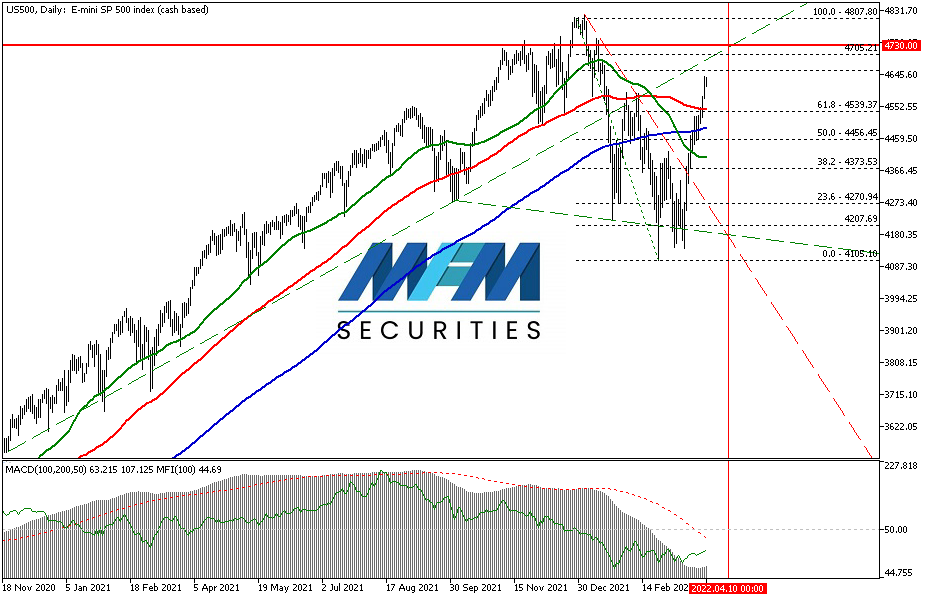

OUR PICK – No New Stock Pick

We see the bear market rally in exhaustion. Though US stocks have rallied the past couple of weeks and are still rallying as the month and quarter come to a close this Friday, we see this more of a bear market rally after the long term uptrend line was broken. Chart below shows that the “wolfe wave” predicted a top rebound at around 4,730 in the S&P 500. Though price is above the 50 (green), 100 (red), and 200 (blue) DMA, trend is changing as the short term 50DMA is crossing below the 100 and 200DMA while momentum and money flow is declining, forming a long term bearish divergence.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.