Stocks Climbed Higher Amid Yields Inversion

MFMTeam

Publish date: Tue, 05 Apr 2022, 09:41 AM

STATE OF THE MARKETS

Stocks climbed higher amid yields inversion. US stocks kicked off the first week of Q2 higher with Dow (+0.30%), Nasdaq (+1.90%) and S&P (+0.81%) including Russell (+0.21%) closed in the green after investors bought the dip in tech and growth stocks. Yields of various maturities dipped after safe-haven demand emerged on institutional hedging, with the 2Y (2.42%) now higher than the 10Y (2.39%). The Dollar climbed higher on the third day, breaking the 99 handle at writing.

In the commodities market, strong demand for major commodities sent crude oil higher and closed above $102.70/bl while gold settled $1,932.40/oz as New York closed. Elsewhere, iron ore continues to break barriers and settled higher around $161.85/tn as markets expect surging demand post China lockdown recently.

In the FX space, the comdolls trio continue to dominate demand across all horizons, though Loonie fell into the offer territories as the safe-haven Yen and Swiss seized the helm of demand in the medium term accounts.

On Tuesday, markets hope for new development in the Russia-Ukraine peace talk while looking for earnings reports from Acuity Brands (AYI), Lindsay (LNN), Array Tech (ARRY), SMART Global (SGH) and Cognyte Software (CGNT) as well as the PMI composite and ISM services index.

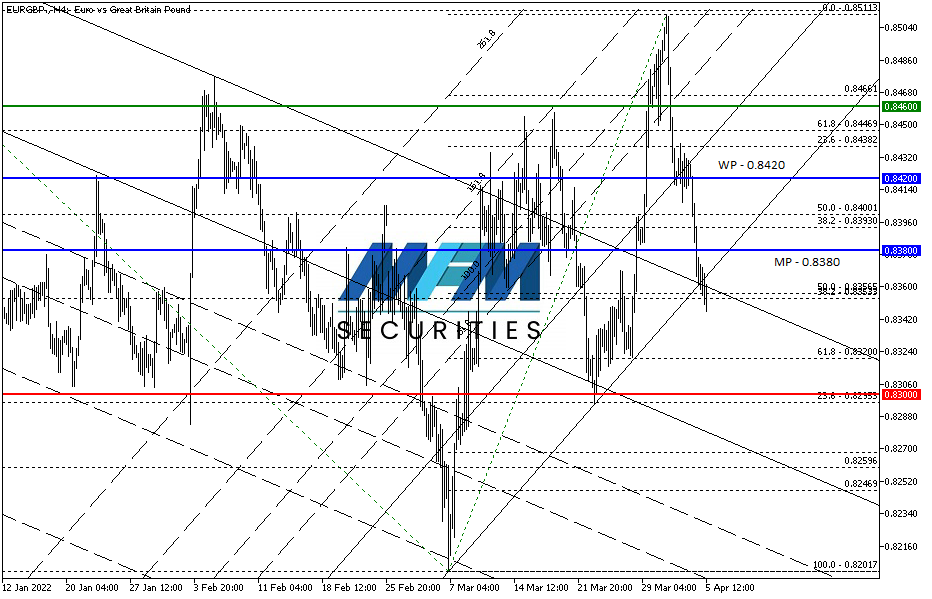

OUR PICK – EUR/GBP

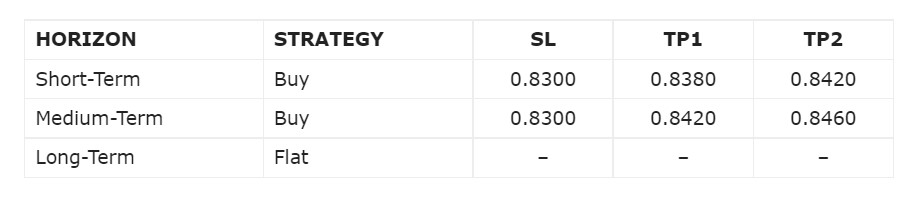

Short term pullback on medium term buy. This is more of a technical trade than a strong fundamentals based trade. Rate differentials clearly favor Sterling than Euro, thus the long term sell sentiments. However, recent flows suggested that medium term buy remains in place and given the favorable technical setup of channel up on the 4 hours, we see a probability of a short to medium term upside in this pair.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.