Equities Tumbled On Hawkish Fed’s Minutes

MFMTeam

Publish date: Thu, 07 Apr 2022, 09:16 AM

STATE OF THE MARKETS

Equities tumbled on hawkish Fed’s minutes. Global equities tumbled on Wednesday after minutes of the FOMC meeting showed a phase of rapid removal of stimulus. FTSE (-0.34%), DAX (-1.89%), Stoxx (-1.58%), Dow (-0.42%), S&P (-0.97%) and Nasdaq (-2.22%) all closed in the red while flows to safe-haven were noted as yields below 10Y fell as bonds prices rose on demand. The yields of 10Y (2.60%) and 30Y (2.62%), however, rose as markets expected Feds to walk their talk.

In the commodities market, crude fell on the news of SPR release from EIA’s member states. The black gold settled below $96.35/bl as New York closed. Gold was resilient on strong bids above the $1,920/oz barrier, unchanged from yesterday. Elsewhere, iron ore was stalled at $161.25/tn waiting for the next catalysts.

In the FX space, King Dollar seized the helm of demand alongside Euro, Sterling and Yen while sending Loonie, Kiwi and Aussie to offers. Sterling ousted Swiss in the medium term demand while long term sentiments were unchanged.

On Thursday, markets continue to look for progress in the peace talks while waiting for earnings reports from Constellation (STZ), Conagra (CAG), Lamb Weston (LW), WD-40 (WDFC), PriceSmart (PSMT) and Apogee (APOG) as well as the latest US jobless claims, and consumer credit figures to assess the health of the US labor markets.

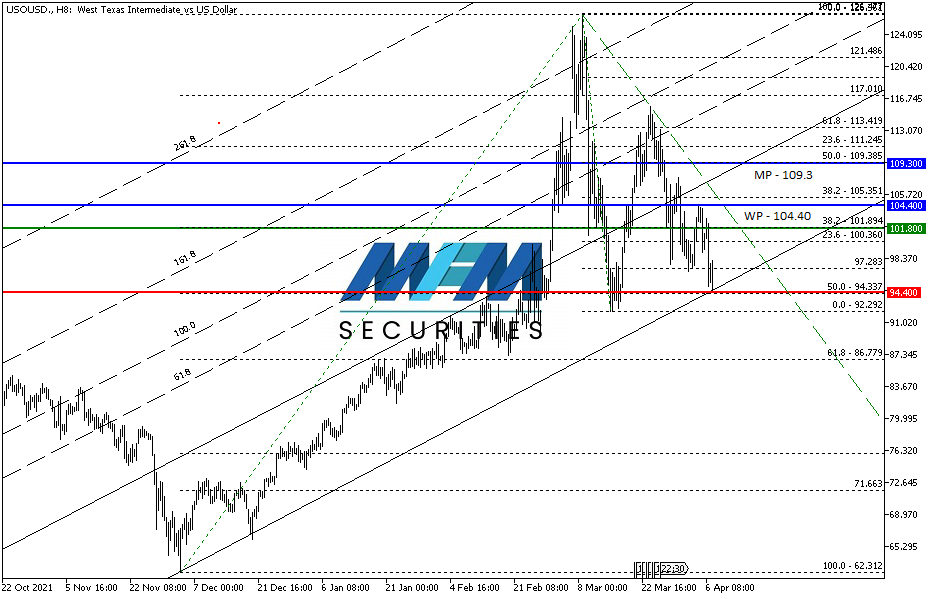

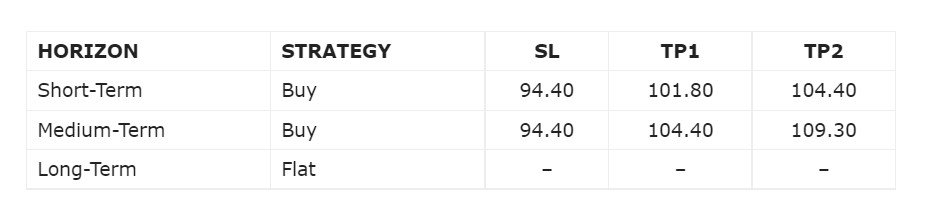

OUR PICK – Crude Oil

Technical Rebound. Price is at a juncture of an uptrend line and we expect a technical rebound in the short to medium term. Risk to the downside remains as continuous SPR release may induce selling pressure and Dollar strength weigh on the commodity.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.