Stocks Fell Ahead of CPI

MFMTeam

Publish date: Tue, 12 Apr 2022, 09:26 AM

STATE OF THE MARKETS

Stocks fell ahead of CPI. US stocks fell lower on Monday after investors decided to stay on the sideline ahead of the inflation reading on Tuesday. Dow (-1.19%), Nasdaq (-2.18%) and S&P (-1.69%) closed in the red as markets expected higher readings and continued bidding in the precious metal complex. The Fed’s hike expectation sent the 10Y yield (2.82%) to the highest since January 2019 while the Dollar finally closed above the 100 major handle.

In the commodities market, crude oil dipped to $92.60/bl before settling below $94.80/bl as fear of diminishing demand amid China lockdown and increased supply from EIA member countries’ strategic release. Gold, however, surged above $1,969.20/oz as markets expect higher inflation reading on Tuesday. Elsewhere, iron ore fell deeper into support, around $156/tn, as markets expect cooling demand from China.

In the FX space, King Dollar continues to hold the ground in long and medium term accounts though short-term traders have started to sell the world’s reserves and bid for more Swiss, Euro and Sterling. Aussie and Kiwi were seen to retreat in demand for the short and medium term accounts.

On Tuesday, markets look for new development in the Russia-Ukraine peace talks while waiting for earnings reports from CarMax (KMX), Albertsons (ACI), Jianpu Tech (JT), AgEagle Aerial Systems (UAVS), Mind Tech (MIND) and Argan (AGX) as well as the Small Business Optimism Index and the very much awaited inflation figures.

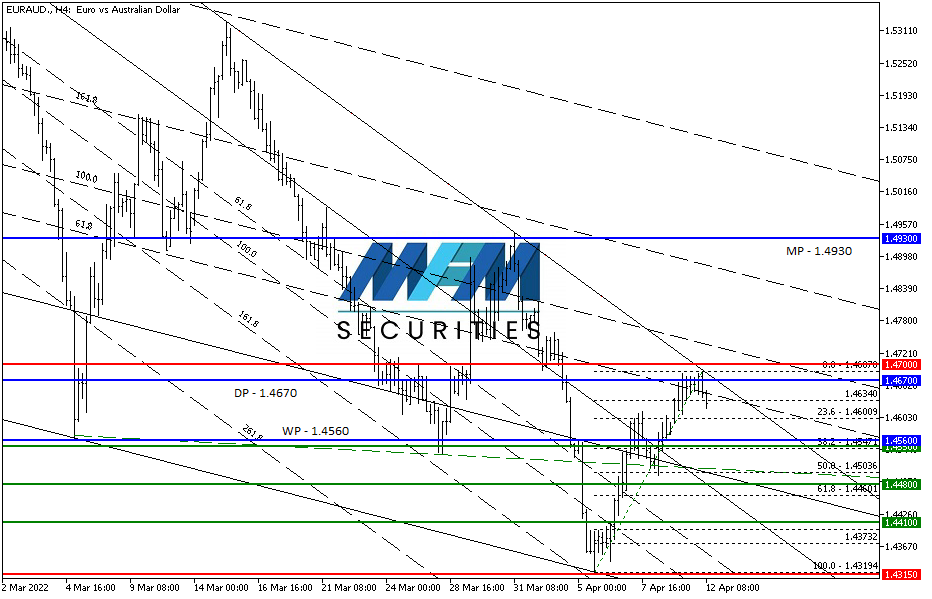

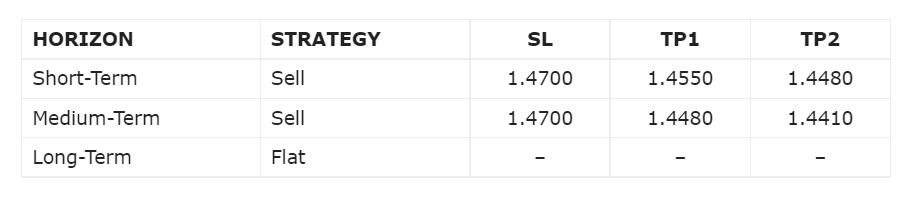

OUR PICK – EUR/AUD

Flow points to higher LT EUR/AUD exchange rate. The last two weeks have seen more flows into Euro than Aussie and we may see the pair bottomed out as the EUR/USD is at the weekly trendline support. Short to medium term risk however remains to the downside as traders prefer the higher yielding currencies than the negative yielding Euro. If 1.4420 hold as support and the pair climbed higher and break the downtrend line, we may see a test of 1.4950

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.