Dollar Eased Amid Safe-Haven Flows

MFMTeam

Publish date: Thu, 14 Apr 2022, 09:28 AM

STATE OF THE MARKETS

Dollar eased amid safe-haven flows. US stocks pared earlier losses and closed sharply higher on Wednesday as markets bet that inflation may have topped. Dow (+1.01%), Nasdaq (2.03%) and S&P (+1.12%), including Russell (+1.92%) were on higher bids as Dollar was sold-off and closed below the 99.85 mark. Safe-haven flows intensifies as yields continue to fall and precious metals continue to gain higher ground. The 10Y benchmark settled around 2.70% as New York closed.

In the commodities market, crude continued to climb higher after reports of large increase in US crude inventories and the black gold settled above $103.60/bl, while Gold continued to be bought on inflation concerns and the precious metal settled near $1,977.50/oz as New York closed. Elsewhere, iron ore stalled around $155.50s/tn waiting for the next catalysts.

In the FX space, Sterling seized the helm of demand in the short and medium term accounts alongside Loonie, Dollar, Euro and Swiss while ousting Kiwi to the back burner. Overall sentiments seemed bearish as demand for Yen increased in the medium term while Aussie and Kiwi were mostly offered.

On Thursday, markets continue to look for progress in the peace talks while waiting for earnings reports from Citigroup (C), Goldman Sachs (GS), Morgan Stanley (MS), Wells Fargo (WFC), United Health (UNH) and Taiwan Semiconductor (TSM) as well as the latest US jobless claims, retail sales, business inventories and consumer sentiment to assess the health of the US economy.

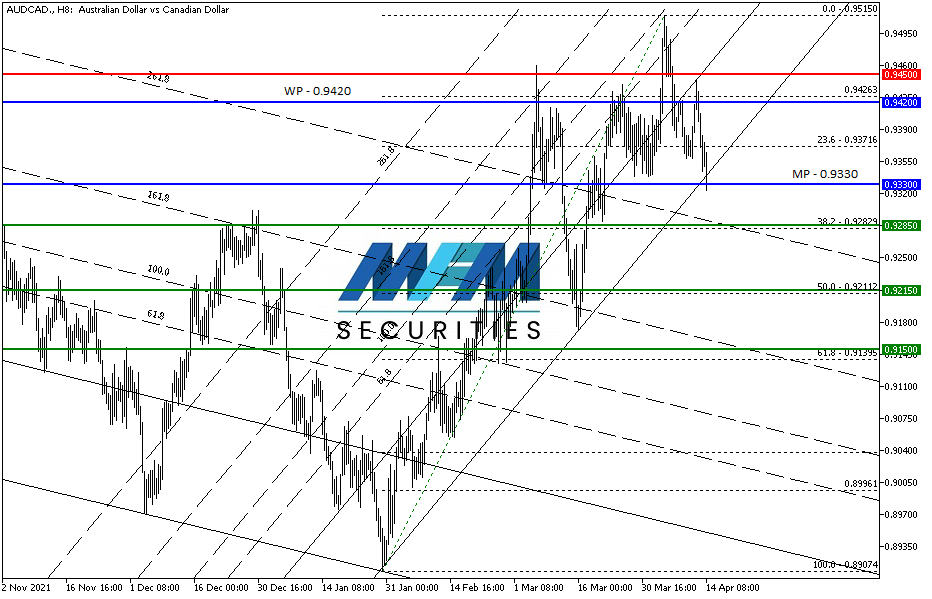

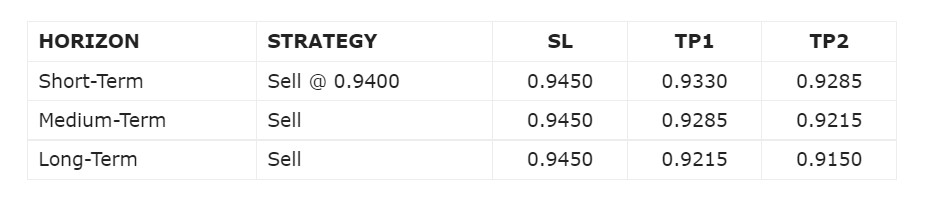

OUR PICK – AUD/CAD

Flows and short term yields favor CAD than AUD. One to three years yields favor Loonie than Aussie, with the 1Y note by 76 basis points. Crude oil resilience added strength to the Loonie as evident in the flows of the two commodity currencies. For short term selling, we favor a limit at 94 with 9450 stop to reduce the risk and maximize the potential gains.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.