Stocks In Limbo As Investors Weary of War

MFMTeam

Publish date: Tue, 19 Apr 2022, 09:21 AM

STATE OF THE MARKETS

Stocks in limbo as investors weary of war. US stocks were flip-flopping on Monday after news of a new Russian offensive was reported in Ukraine. Weary of war, investors sold into gains and the major index closed lower with the majority running for cash. Dow (-0.11%), Nasdaq (-0.14%) and S&P (-0.02%) including Russell (-0.74%) lost ground as the Dollar index surged past the 101 figure. Long term bonds were sold off, sending yields higher, with the 10Y benchmark spiked to 2.88%, while the shorter 2Y was bought, pulling yields lower to 2.45%.

In the commodities market, crude was bid higher after news of Libya supply outages, and the black gold settled above $106.85/bl as New York closed. News of Russian offense, sending gold as high as $1,998.20/oz before settling lower around $1,978.65/oz. Elsewhere, iron ore was holding strong the $155.60/tn support despite the ongoing lockdown in China.

In the FX space, King Dollar and Loonie reigned in demand alongside Euro and Sterling in the short and medium term accounts, while Aussie and Kiwi were sent to offers. Overall sentiments turned more bearish as Swiss and Yen were more in demand across the board.

On Tuesday, markets hope for new development in the Russia-Ukraine peace talk while looking for earnings reports from Netflix (NFLX), Johnson & Johnson (JNJ), Las Vegas Sands (LVS), Lockheed Martin (LMT), Haliburton (HAL), Fifth Third Bancorp (FITB) and International Business Machines (IBM) as well as the latest numbers on US housing starts and permits.

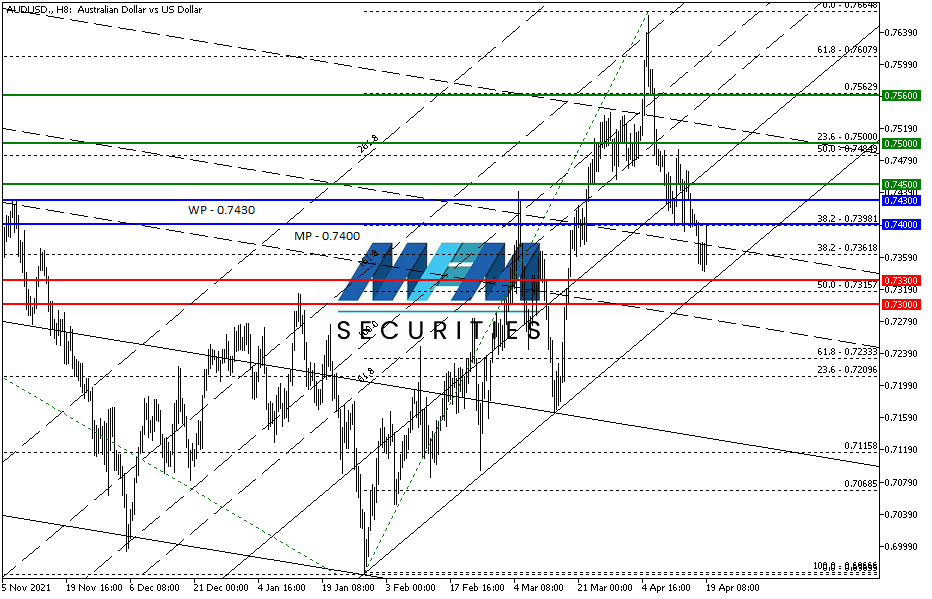

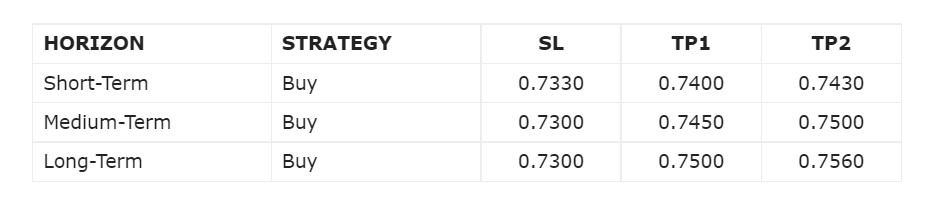

OUR PICK – AUD/USD

On long term uptrend. Long term flows suggested that Aussie is being bought and the recent strength in commodities only support the case, plus 7Y, 10Y and 30Y yields favor the Aussie for now. RBA minutes today pointed to an earlier than expected rate hike plan. The exchange rate is at monthly, weekly and daily uptrend lines. Downside risk remains however in case of a spike down for a large order pick-up.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.