Stocks Jumped Amid The Dollar Rally

MFMTeam

Publish date: Tue, 26 Apr 2022, 09:21 AM

STATE OF THE MARKETS

Stocks jumped amid the Dollar rally. US stocks pared earlier losses and closed sharply higher on Monday after news of Twitter going private at $54.20/share. Dow (+0.70%), Nasdaq (+1.29%) and S&P (+0.57%), including Russell (+0.70%) closed in the green as Dollar rallied for the third day, piercing past the 101.80 barrier. Safe haven flows were noted with the rise in Yen flows late last week, prompting bonds demands, sending yields lower, with the 10Y benchmark dipped to 2.76%

In the commodities market, crude dipped to as low as $95/bl on demand concerns amid China new lockdowns, before bidders emerged to settle the black gold higher around $98.30/bl. Dollar strengths continue to plague gold and iron ore as the two metals dived deeper into support. Gold settled around $1897.20/oz while iron ore at $152.45/tn as New York closed.

In the FX space, bearish sentiments intensified as King Dollar seized the helm of demand from Aussie in the long term accounts as Swiss catapulted to the demand territories alongside Loonie. Short term traders were seen selling Aussie, Euro and Sterling, while buying the safe-haven trios – Yen, Dollar and Swiss.

On Tuesday, markets seemed less optimistic about the peace talks but look forward to seeing earning reports from the big tech – Alphabet (GOOGL), Microsoft (MSFT) – among others – Visa (V), Texas Instruments (TXN), General Motors (GM), 3M (MMM), General Electric (GE), United Parcel Service (UPS), Pepsi Co (PEP) and Waste Management (WM) as well as the latest US durable goods orders, consumer confidence, home price index, new home sales and Richmond Fed manufacturing index.

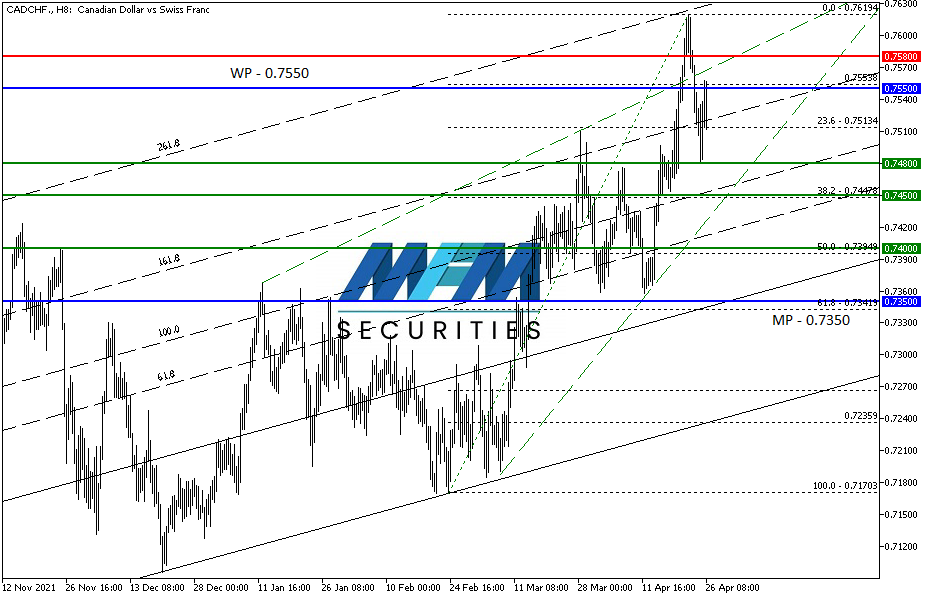

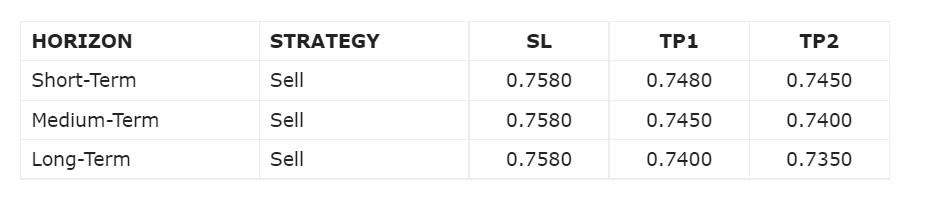

OUR PICK – CAD/CHF

Risk-off is around the corner. Surge in Yen flows late last week was an indication that the market is turning around for the worst. Risk-off is around the corner as we observed block orders in Swiss, Euro and Loonie on the ETF front. Commodity currencies usually are the victims and we have seen Aussie and Kiwi were sold-off sharply. We expect Loonie is next.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.