Stocks Rally As Fed Rolls Less Hawkish Hikes

MFMTeam

Publish date: Thu, 05 May 2022, 09:09 AM

STATE OF THE MARKETS

Stocks rally as Fed rolls less hawkish hikes. US stocks rallied on Wednesday after Fed Chair Powell ruled out 75 basis points hike off the table in its plan to combat inflation. Nasdaq (+3.19%) made the biggest gains, followed by S&P (+2.99%), Dow (+2.81%) and Russell (+2.69%) as Dollar was sold off the 103.50 minor handle and dropped to the next 102.50 mark as New York closed. Demand for safe havens were noted as yields fell, except for the 30Y (3.00%), with inversions between 5Y (3.02%), 7Y (3.03%) and 10Y (2.97%) remains.

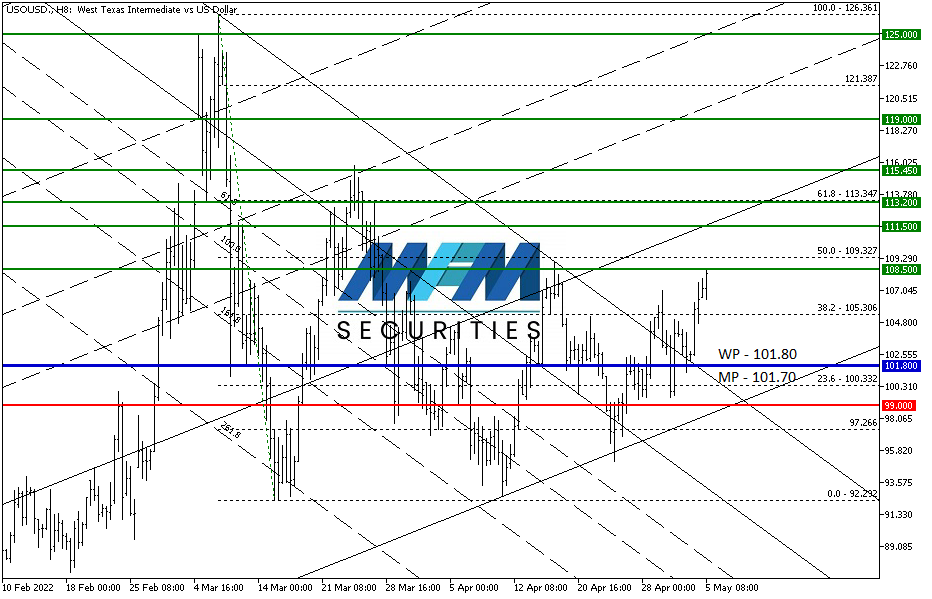

In the commodities market, crude surged higher as the European Union geared to phase out Russian oil and the black gold hovering around $107/bl at writing. Fed’s less hawkish policy sent cheers to gold bugs as the metal was bid and on the way to test $1,900/oz at writing. Elsewhere, iron ore remains stalled at $144/tn waiting for a new catalyst for the next move.

In the FX space, short and medium term accounts demand more of the comdolls alongside Sterling as demand for Dollar fades. Sentiments are more bullish in the short and medium terms, though long term investors demand more Yen than Swiss.

On Thursday, markets continue to look for EU announcement of new sanctions on Russia, while waiting for earnings reports from ConocoPhillips (COP), Zillow (Z), Block Inc (SQ), Hanesbrands (HBI), Kellogg (K), Royal Caribbean Group (RCL) and Becton Dickinson (BDX) as well as the latest US jobless claims, productivity and costs to assess the health of the US economy.

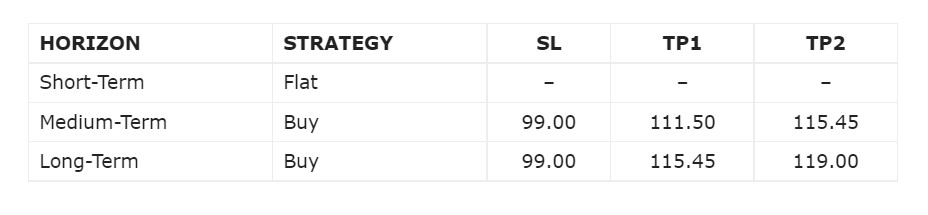

OUR PICK – Crude Oil

Short term TP2 reached, update stop and revise targets. Last week our pick on crude worked as planned and we saw a new target at $111.50/bl before another pullback and revised long term target to $119/bl. Update stop to $99/bl. Wait on pullback to reduce risk, if you decide to enter this trade.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.