Stocks Rebound As The Dollar Falls

MFMTeam

Publish date: Wed, 18 May 2022, 09:23 AM

STATE OF THE MARKETS

Stocks rebound as the Dollar falls. US stocks climbed higher on Tuesday after news of better economic data helped bidders scooped oversold growth and tech stocks. Dow (+1.34%), S&P (+2.02%) and Nasdaq (+2.76%), including Russell (+3.19%) closed in the green as Dollar was sold off amid profit taking from long term buyers. The Dollar index closed around the 103.30 mark while the 10Y yield rebounded to 2.99% as demand fell after Fed’s Kashkari gave aggressive remarks on rate hikes.

In the commodities market, crude edged lower on profit taking, but remained well bid above $110.60/bl as New York closed. Gold pared earlier gains to close below $1,815/oz as investors continue to bid Dollar on higher rates expectation. Elsewhere, iron ore retreated to $132.60/tn as investors continue to weigh the demand recovery from China.

In the FX space, demand for Sterling spiked in the short and medium term accounts as speculation ran high that BoE had to hike more to contain inflation. Overall sentiments turned bullish as demand for safe haven Swiss, Yen and Dollar retreated, though Dollar remained King in long term demand.

On Wednesday, markets are expected to remain cautious while looking forward to earning reports from Lowe’s (LOW), Target (TGT), Analog Devices (ADI), Progressive (PGR), Cisco (CSCO), Bath & Body Works (BBWI), Synopsys (SNPS and ZIM Shipping (ZIM) as well as the latest figures in US housing starts and permits. EIA petroleum status will be in the spotlight for energy traders.

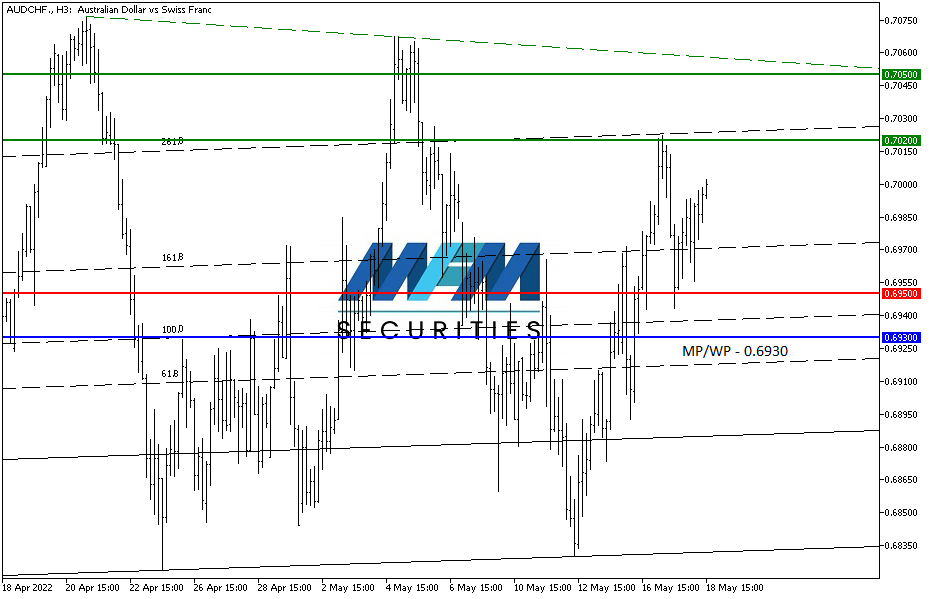

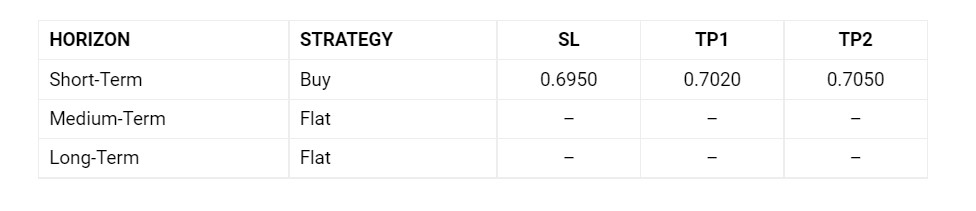

OUR PICK – AUD/CHF

On short term rebound. Oversold commodity currencies are being picked up on higher interest rate expectations from global central banks as sentiments turned bullish. Update stop to 0.6970 as TP1 reached.

For more high probability picks, please use our Trading Central services.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.