Equities Rebound As The US Closes For Juneteenth

MFMTeam

Publish date: Tue, 21 Jun 2022, 09:07 AM

STATE OF THE MARKETS

Equities rebound as the US closes for Juneteenth. Global equities from FTSE (+1.50%), DAX (+1.06%), Nikkei (+2.43%) and Hang Seng (+1.59%) climbed higher on Monday, while the US markets closed for the Juneteenth federal holiday for the first time in history. As of last Friday, yield inversion remained between the 3Y (3.41%), 5Y (3.39%), 7Y (3.38%), 10Y (3.28%) and 30Y (3.35%) while the Dollar index stalled below the 104.50 minor handle.

In the commodities market, China’s reopening and summer demands continue to float crude above $108.75/bl. Gold was under pressure as investors weighed further rate decisions by the US Federal Reserves. The yellow metal settled below $1837.75/oz as New York closed. Elsewhere, iron ore dived deeper to $135.70/tn as markets continue to weigh on IMF forecasts for lower global growth.

In the FX space, markets remain cautious as Swiss demand continues to reign across all horizons, though Loonie and Sterling lead in the short term accounts. King Dollar is under selling pressure as investors picked up demand in Aussie, Kiwi, Euro and Sterling.

On Tuesday, the US markets may look for bargain hunting while waiting for earning reports from Lennar Corp (LEN), LaZBoy (LZB), Progressive Corp (PGR) and eXp world (EXPI) as well as the latest numbers in the US home sales and Chicago PMI.

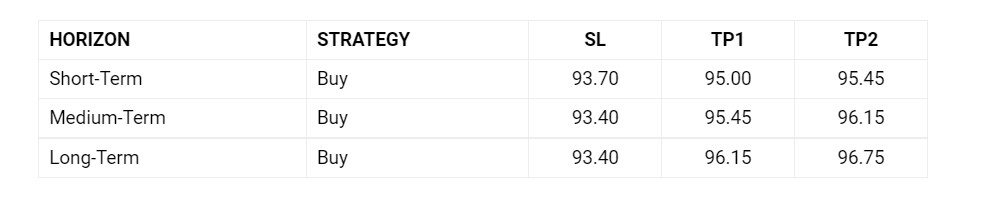

OUR PICK – AUD/JPY.

BoJ remains bearish. Recent announcement by BoJ to keep its easing policy while other central banks are tightening signaled bearish sentiments for Yen remains. At least for now as inflation in Japan is not as bad as it is in other countries. Last CPI reading was 2.5% vs 1.2% prior and we see traders to keep selling Yen for now.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.