Dollar Firms As Stocks Retreat

MFMTeam

Publish date: Thu, 23 Jun 2022, 09:21 AM

STATE OF THE MARKETS

Dollar firms as stocks retreat. US stocks retreated lower on Wednesday after Fed’s Powell confirmed the risk of recession has increased as the Federal Reserve ramped up rates in a move to tame inflation. Dow (-0.15%), S&P (-0.13%) and Nasdaq (-0.15%), including Russell (-0.22%) closed in the red as investors continued to bid Dollar above the 104.20 barrier. Flight to safety continued as yields fell further, with the 10Y benchmark closed at 3.16%.

In the commodities market, crude continues its downward trajectory after President Biden announced a tax holiday on gasoline and a ban on oil exports. The black gold settled around $103.88/bl as New York closed. Dollar strength put gold under pressure but the metal managed to close higher around $1837.50/oz while iron ore continued to fall deeper around $127.90/tn.

In the FX space, overall sentiments turned bearish as the safe haven Swiss seized the helm of demand across all horizons while Euro advanced further into the demand territories. Long term investors flipped Dollar to demand while sending Aussie to offers.

On Thursday, markets expect another volatile and choppy session as Fed’s Powell continues his testimony. Earnings report to watch includes Accenture (ACN), FedEx (FDX), Darden Restaurants (DRI), Factset Research (FDS), BlackBerry (BB) and GMS Inc (GMS) as well as the latest figures in US jobless claims and composite PMIs.

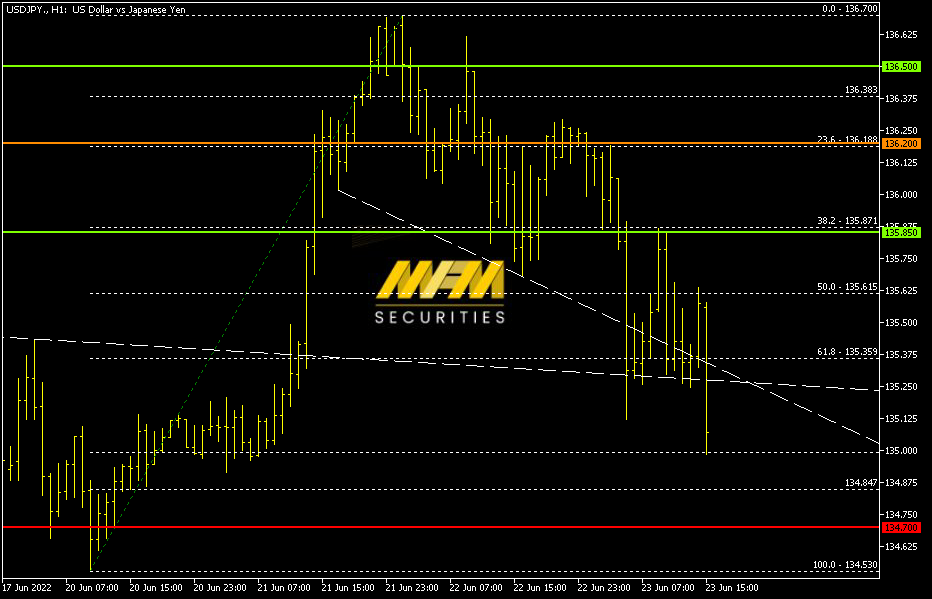

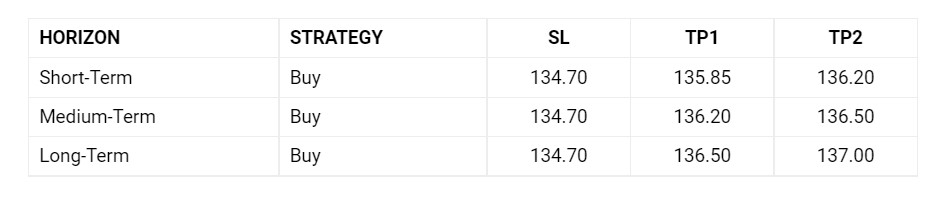

OUR PICK – USD/JPY

Upside risk remains as BoJ stays bearish. BoJ’s recent announcement to keep its easing policy is more likely to keep Yen under selling pressure. We see further upside risk in USD/JPY in the medium term.

For more high probability picks, please use our Trading Central services.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.