Equities Mixed As The US Closes For Independence Day

MFMTeam

Publish date: Tue, 05 Jul 2022, 09:22 AM

STATE OF THE MARKETS

Equities mixed as the US closes for Independence Day. Global equities from FTSE (+0.89%), DAX (-0.31%), Nikkei (+0.84%) and Hang Seng (-0.13%) closed mixed on Monday, while the US markets closed for Independence day. As of last Friday, flights to safety was the order of the day as yields fell across the board on bond demands. Inversion remained between the 7Y (2.94%) and 10Y (2.90%) while the Dollar index was little changed at the 105.20 barrier.

In the commodities market, China’s reopening and summer demands continue to push crude higher, above $108.60/bl. Gold dipped and rebound sharply higher on Friday and remained well bids above the $1,800/oz psychological handle. Elsewhere, iron ore gapped lower to $114.50/tn as markets continue to weigh on global recessions.

In the FX space, markets seemed to be perking up as demand for the safe haven Swiss and Yen dissipated, while demand for Dollar, Kiwi, Aussie and Loonie returned. We expect markets to remain cautious.

On Tuesday, the US markets may look for bargain hunting as it opens for the week while waiting for earning reports from HNI Corp (LEN) as well as the latest numbers in the US vehicle sales and factory orders.

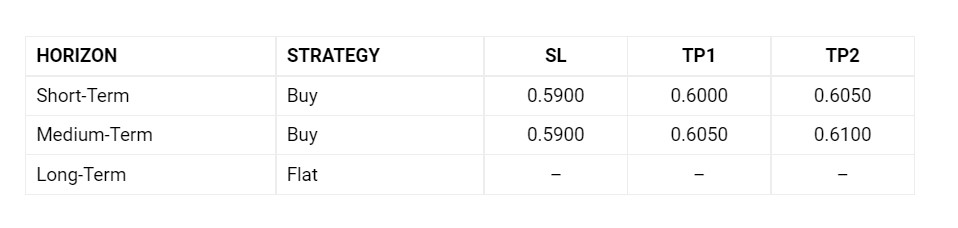

OUR PICK – NZD/CHF

Short term bulls returned. Our sentiment model indicates a bullish Kiwi against Swiss in the short term at least. Kiwi remains favorable on a yield basis. RBNZ at 2% may hike further to contain inflation. Risk of sudden change in sentiment remains, however.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.