Yields Spike Amid Hotter Than Expected CPI

MFMTeam

Publish date: Thu, 14 Jul 2022, 09:24 AM

STATE OF THE MARKETS

Yields spike amid hotter than expected CPI. US stocks dip lower on Wednesday after news of hotter than expected CPI (9.1% vs 8.8%) while short term yield of 1Y (3.21%) note spiked higher than the longer 30Y (3.07%). Dow (-0.67%), S&P (-0.45%) and Nasdaq (-0.15%), including Russell (-0.12%) edged lower as demand for Dollar firmed amid higher yields. Talks of more aggressive hikes sent the Dollar index past the 108.50 minor handle.

In the commodity markets, crude was little changed at $94.15/bl as New York closed while inflation concerns pushed gold to close higher above $1,735.25/oz. Elsewhere, Iron ore rebounded to $111.05/tn as short sellers took profit.

In the FX space, short term traders were back into selling Yen, Kiwi and Aussie while buying Swiss, Loonie and Euro. Demand for Loonie returned across the board after the Bank of Canada surprised the markets with a 100 basis point hike. Long term sentiments were little changed.

On Thursday, markets expect a higher volatility as earnings seasons kicked in with reports from Taiwan Semiconductor (TSM), JP Morgan (JPM), Morgan Stanley (MS), Cintas Corp (CTAS), First Republic Bank (FRC), Ericsson (ERIC), Conagra Brands (CAG) and American Outdoor (AOUT). Market moving economic calendar includes jobless claims, Empire State manufacturing index, industrial production and consumer sentiments.

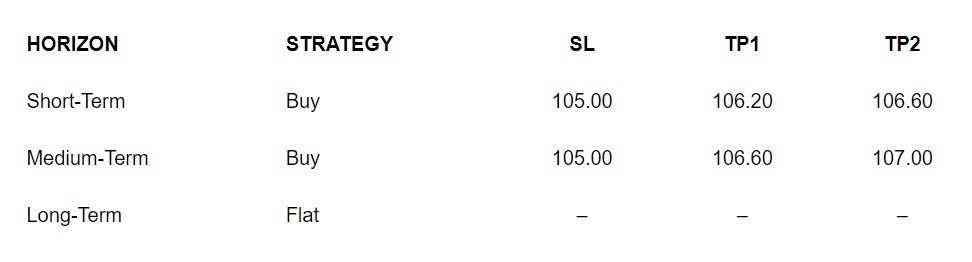

OUR PICK – CAD/JPY

Among best short term yields. Latest hike from the Bank of Canada put Loonie at par with Kiwi at 2.50% and the short term yields are among the best. Sentiments indicate a short and medium term rebound is on the card. Long term, however, is prone to reversal as the exchange rate is already at 2015 and 2008 high.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.