Stocks Charge Higher As Dollar Retreats

MFMTeam

Publish date: Wed, 20 Jul 2022, 09:22 AM

STATE OF THE MARKETS

Stocks charge higher as Dollar retreats. US stocks closed higher on Tuesday after a series of better than expected earnings releases that saw investors bid for small caps and tech names. Small cap Russell (+3.50%) gained the most, followed by the tech-laden Nasdaq (+3.11%), S&P (+2.76%) and Dow (+2.43%) while the Dollar index formed a bearish signal – the three black crow – as it closed below the 106.70 mark. As at writing, yield inversions remain between the 1Y (3.20%), 2Y (3.20%), 5Y (3.11%), 10Y (2.98%) and the 30Y (3.15%).

In the commodities market, weaker Dollar helped buoyed major commodities, with crude regained the $100/bl handle while gold remained firm above the $1,700/oz handle. Elsewhere, iron ore however failed to float on a weaker Dollar as the commodity fell to $104.80/tn on concerns of slowing global demand.

In the FX space, Yen and Sterling were seen synching in the offer territories across the board, with Loonie and King Dollar in the short and medium term accounts. In the demand territories, Aussie and Swiss were seen synching in the short and medium term accounts; signaling a change in trend might be on the way for the oversold high beta currencies.

On Wednesday, markets expect to bid more bargains in equities while waiting for earning reports from Tesla (TSLA), ASML Holdings (ASML), Abbott Labs (ABT), Elevance Health (ELV), Crown Castle (CCI), CSX Corp (CSX), Kinder Morgan (KMI), Biogen (BIIB), United Airlines (UAL) and Steel Dynamics (STLD) as well as the latest figures on US home sales and mortgage application index. EIA crude oil inventories will be in the spotlight for energy traders.

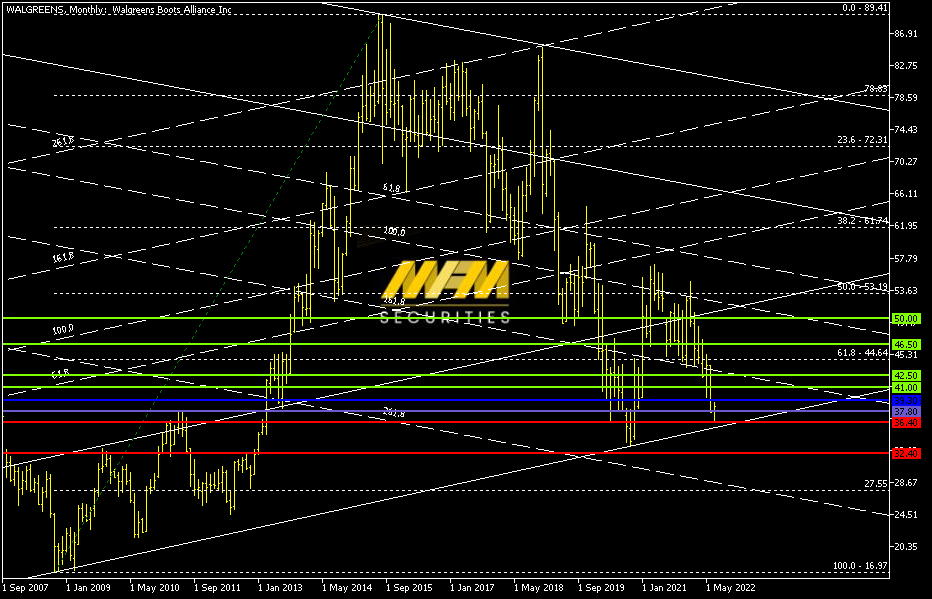

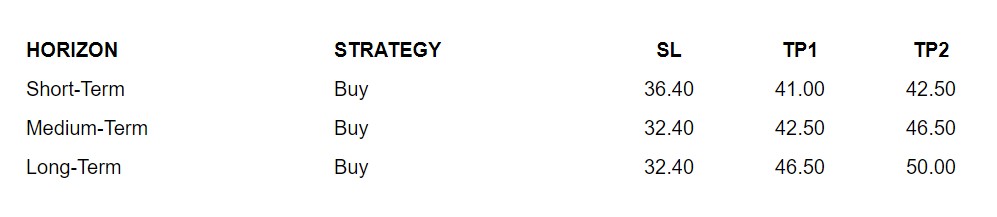

OUR PICK – Walgreens Boots Alliance (WBA, NASDAQ)

Strong balance sheet, with least valuation risk. If you are looking for a stock to add for your long term retirement portfolio, WBA offers 5% yields with forward PE of 8.8 (industry is 11.4) and forward PEG of 9.9 (industry is 1.9). The company net margin has been higher than its industry average for the past five years and analysts consensus sees 25 to 30% upside in fair value.

For more high probability picks, please use our Trading Central services.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.