Stocks Wobbled Amid The US – China Tension

MFMTeam

Publish date: Wed, 03 Aug 2022, 09:30 AM

STATE OF THE MARKETS

Stocks wobbled amid the US – China tension. US stocks closed lower on Tuesday after the US House Speaker visited Taiwan in a rising tension between the US and China. Worst than expected jobs openings data was not helping in already distressed markets. Dow (-1.23%) fell the most, followed by S&P (-0.67%), Nasdaq (-0.16%) and Russell (-0.05%) as the Dollar index rebounded to close above the 106.40 mark.

Bonds were sold-off, sending yields higher across the board. As at writing, yield inversions remain to be seen with the 1Y (3.11%), 2Y (3.07%) and 30Y (3.02%) yields above 3% while the 5Y (2.86%), 7Y (2.84%) and 10Y (2.76%) yields below 3%.

In the commodities market, crude was firm above the $93/bl handle ahead of the OPEC meeting that is expected to curb supply amid growing concerns of global recession that would limit demand. Gold pulled back to close below $1,760/oz as profit taking and Dollar strength pushed the metal lower. Similar fate sent iron ore lower to $113.30/tn as New York closed.

In the FX space, short term traders were quick to sell the overbought Yen and demand Dollar, Loonie and Sterling while medium term investors demand more Sterling and Euro alongside Yen. Long term accounts seemed bullish as Swiss flipped to offer while Dollar flipped to demand alongside Aussie, Loonie and Yen.

On Wednesday, markets expect to remain cautious as China continues to watch over Taiwan. Earnings reports to watch will be from CVS Health (CVS), Booking Holdings (BKNG), Moderna (MRNA), Regeneron Pharma (REGN), Cars (CARS), eBay (EBAY), Autohome (ATHM), Under Armour (UAA) and Metlife (MET) as well as the latest figures on US factory orders, services PMI and mortgage application index. EIA crude oil inventories will be in the spotlight for energy traders.

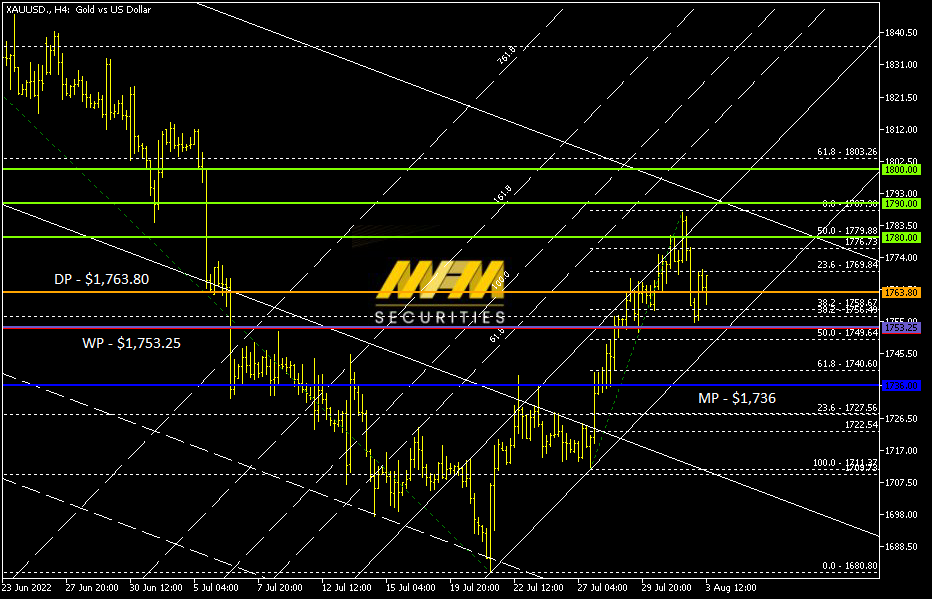

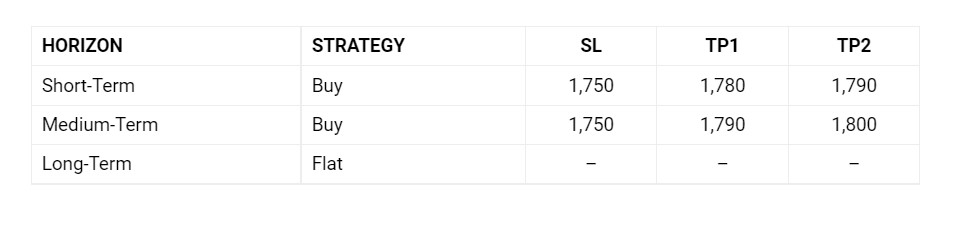

OUR PICK – XAU/USD

Another leg higher. With rising tension between the US and China, VIX jumped off the 22 handle yesterday and looks poised to climb further. Bonds were sold-off and precious metals were on heavy bid in early Wednesday trading. We see another leg higher to test the $1800 handle as block orders are seen bidding above the $1,770/oz mark.

For more high probability picks, please use our Trading Central services.

Risk Disclaimer:

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.