Stocks Surged Higher As The Dollar Firm

MFMTeam

Publish date: Thu, 04 Aug 2022, 09:58 AM

STATE OF THE MARKETS

Stocks surged higher as the Dollar firm. US stocks surged higher on Wednesday after a series of solid earnings from PayPal (PYPL), Lam Research (LRCX), Starbucks (SBUX) and AutoHome (ATHM) brought back buyers into bidding as the Dollar firm near the 106.50 minor handle. Nasdaq (+2.59%) jumped the most, followed by S&P (+1.56%), Russell (+1.41%) and Dow (+1.29%) as the 10Y benchmark was sold off, sending yields higher to 2.85% before bidders emerged to force yields back to 2.70%.

In the commodity markets, global growth concerns and firm Dollar continue to weigh on crude that fell lower and settled below $90.40/bl as New York closed. Tensions in South East Asia saw gold bid higher and continue to climb past $1780/oz in early Thursday trading. Elsewhere, iron ore fell back to $110.10/tn as buyers fizzled amid demand concerns.

In the FX space, overall sentiments mixed as demand for high beta Kiwi, Aussie and Loonie were elevated despite the reign of Yen in the medium and long term accounts. Short term traders continue to sell Yen, Swiss and Dollar while buying Kiwi, Aussie and Loonie.

On Thursday, markets expect to scoop further bargains as more earnings reports come in from Eli Lilly (LLY), Alibaba (BABA), Amgen (AMGN), ConocoPhillips (COP), Cigna (CI), Duke Energy (DUK), Zoetis (ZTS), Vertex Pharma (VRTX) and Block (SQ) as well as the latest US jobless claims and the trade balance.

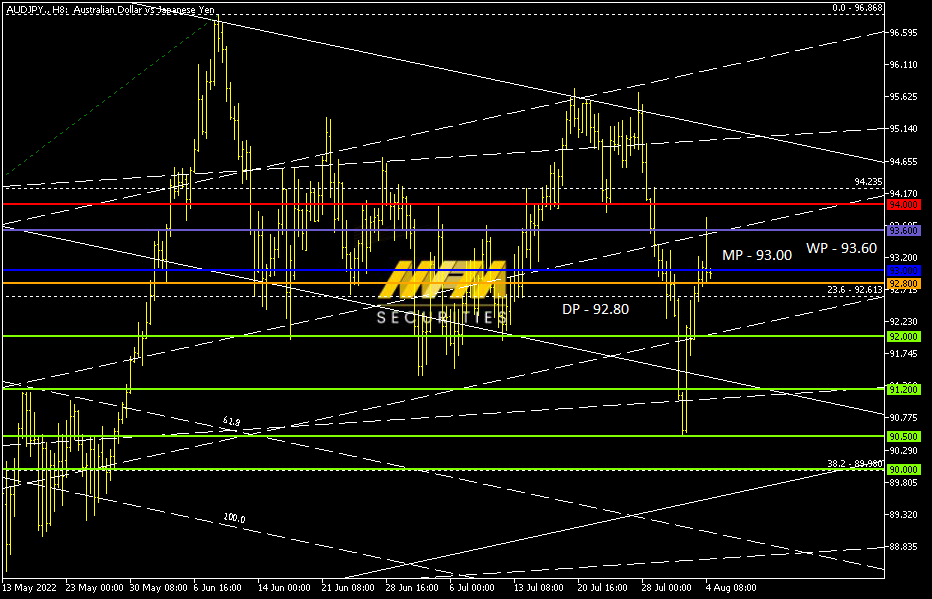

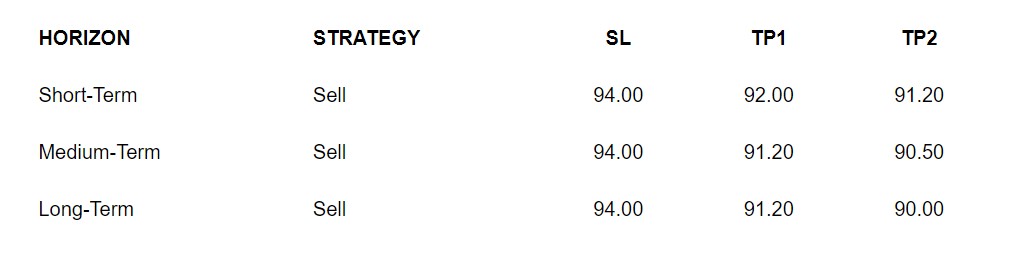

OUR PICK – AUD/JPY

Medium term under pressure with long term upside capped. Sentiments model showed upside remained capped while medium term continue to be under pressure. The sell-off in the London session signaled a resumption of Yen buying as markets weary of the US-China tension amid Taiwan visit by the US house speaker Pelosi. We see the risk of another drop to the downside.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.