Stocks Wobbled Ahead of Inflation

MFMTeam

Publish date: Wed, 10 Aug 2022, 09:25 AM

STATE OF THE MARKETS

Stocks wobbled ahead of inflation. US stocks closed lower on Tuesday as short term traders took profits ahead of the very much awaited inflation data. The small cap Russell (-1.46%) fell the most, followed by Nasdaq (-1.19%), Dow (-0.18%) and S&P (-0.42%) as investors sold bonds, sending yields higher, with the 10Y benchmark nearing 2.80%. As at writing, Dollar index has broken down the 106 handle as speculators may have seen a peak inflation.

In the commodity markets, crude was under pressure as recession fears put a cap on the commodity. The black gold settled unchanged around $89.80/bl as New York closed. Gold continues to push higher and break the $1800/oz handle as inflation fears remain in the mind of investors. Elsewhere, global growth concerns continue to press iron ore lower to $109.80/tn.

In the FX space, overall sentiments seemed mixed as safe haven swiss return to demand across the board alongside Aussie and Kiwi. Demand for King Dollar was seen synchronized in the offer zones at the border of demand.

On Wednesday, markets expect another volatile trading while looking for earnings reports from Walt Disney (DIS), Fox Corp (FOXA), Manulife Financial (MFC), Coupang (CPNG), Franco Nevada (FNV), Nio Inc (NIO), Avnet (AVT) and Nomad Foods (NOMD) as well as the latest numbers on US mortgage application and the very much awaited inflation data. EIA petroleum status will be in the spotlight for energy traders.

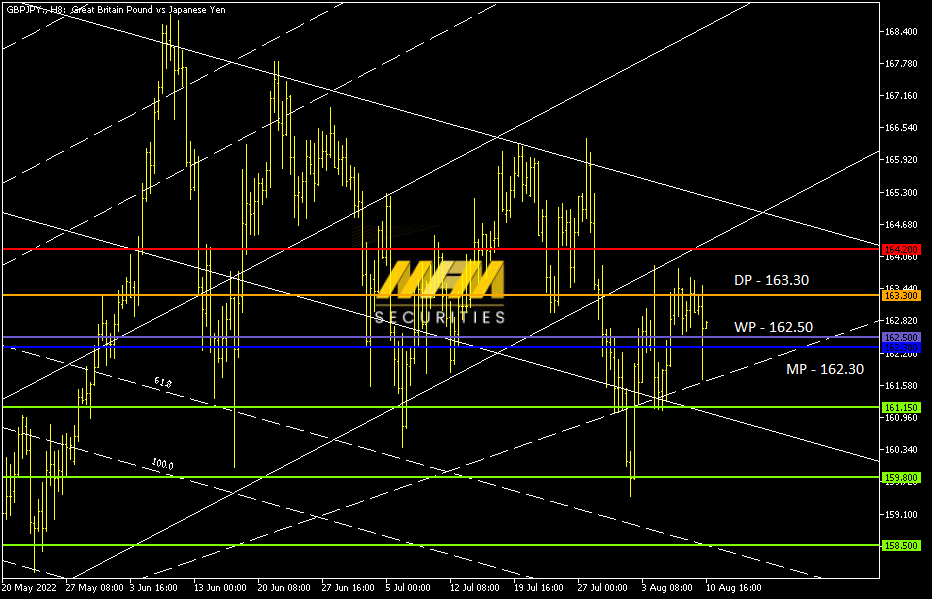

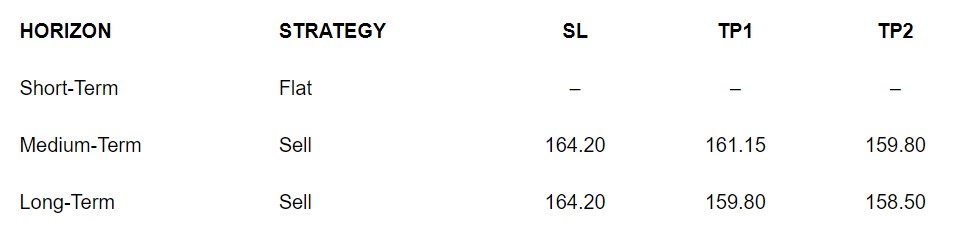

OUR PICK – GBP/JPY

Long term sentiments remain bearish. As the political situation in the UK remains uncertain until early September as the new Prime Minister is being appointed, we expect any upside in Sterling is going to be short lived. Any positive economic data however, may push Sterling higher to the upper bound of the down trend line circa 164.80/165.00 where we may re-enter our short.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.