Stocks Rallied As Inflation Eased

MFMTeam

Publish date: Thu, 11 Aug 2022, 09:21 AM

STATE OF THE MARKETS

Stocks rallied as inflation eased. US stocks rallied higher on Wednesday after inflation was reported lower in July, sending speculation that the Feds might not raise as much rate as had expected. Subsequently, the Dollar index fell below the 105 handle as major averages surged higher. Small caps Russell (+2.95%) led the rally, followed by the tech-laden Nasdaq (+2.89%), S&P (+2.13%) and Dow (+1.63%). Long term investors however remained cautious as bonds were bought, sending yields lower, before settling relatively unchanged. As at writing, inversions remained to be seen in 1Y (3.29%), 2Y (3.23%), 5Y (2.94%) and the 10Y (2.80%).

In the commodity markets, Dollar weakness pushed major commodities higher with crude rebounded back above $91/bl while gold surged past $1800/oz before pulling back lower on profit taking. Elsewhere, iron ore however, continues to press lower as global recession continues to weigh on the commodity. It settled 20 cents lower, around $109.60/tn as New York closed.

In the FX space, overall sentiments seemed slightly bullish as demand for Swiss pulled back while Kiwi and Aussie reigned in the helm of demand across all horizons. King Dollar was seen sold off across the board as markets reprice Fed’s hike post inflation data.

On Thursday, markets expect to scoop further bargains as more earnings reports come in from Brookfield Asset Management (BAM), Illumina (ILMN), Rivian Auto (RIVN), Resmed (RMD), Cardinal Health (CAH), Wheaton Metals (WPM), US Foods (USFD), Dillard’s (DDS) and Applied Industrial Tech (AIT) as well as the latest US jobless claims and Producers Price Index.

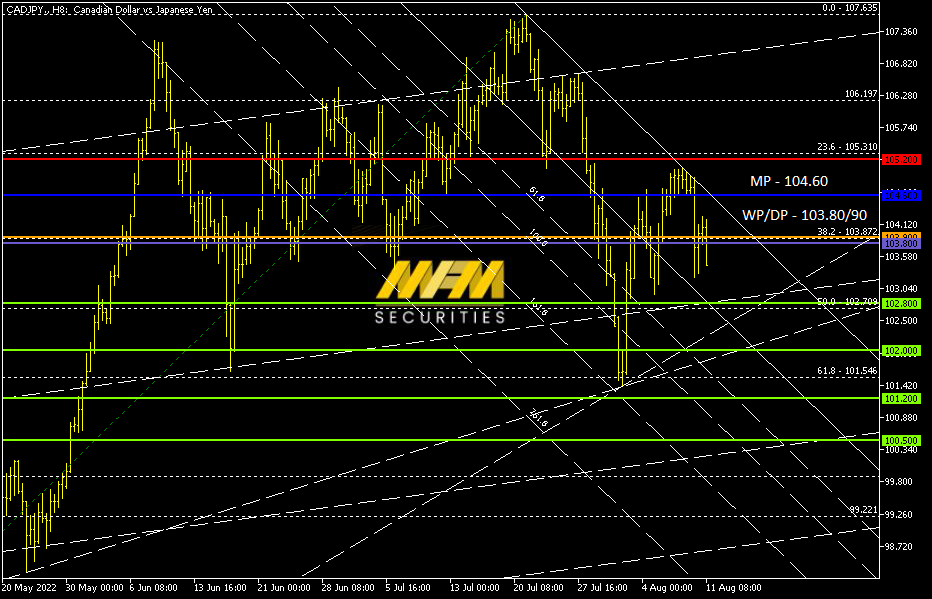

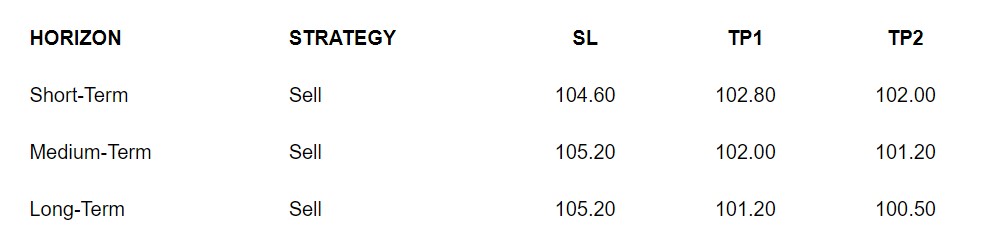

OUR PICK – CAD/JPY

Risk sentiments and weaker crude capped Loonie. Sentiments model showed upside remained capped as Loonie tried to rally against Yen in the medium term. We expect crude weakness to continue as the global recession continues to weigh in the minds of investors. Recent IMF projection of a global growth slowdown was not helping sentiments either. Continuous outflow from the equities markets showed that long term investors remain skeptical and prefer to hold cash.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.