Bonds, Stocks & The Dollar Climbed Higher

MFMTeam

Publish date: Tue, 16 Aug 2022, 09:16 AM

STATE OF THE MARKETS

Bonds, stocks and the Dollar climbed higher. US stocks closed higher on Monday together with the Dollar and bonds across the board, after the People Bank of China unexpectedly cut the rate for the medium term lending facility. The move sent fears across markets as global growth slowed down, sending yields lower, with the US10Y benchmark back below the 2.80% as the Dollar index climbed back to the 106.50 minor handle.

Yield inversions remain to be seen, with the shorter 1Y (3.23%) and 2Y (3.21%) yield above the longer 5Y (2.91%), 10Y (2.80%) and even the 30Y (3.11%).

In the commodity markets, crude fell to $86.30/bl after Chinese data stoked demand concerns from the world’s largest oil importer. Gold drifted lower on profit taking after reaching the $1,800/oz major handle. The precious metal settled below $1779.50/oz as New York closed. Elsewhere, sour sentiments and global recession concerns sent iron ore lower to $107.60/tn.

In the FX space, sentiments turned bearish after the Chinese data spooked markets with demand for the safe haven Swiss and Yen returned across the board. Medium and long term accounts seemed hopeful as Kiwi and Aussie remained in the demand territories alongside Swiss and Yen.

On Tuesday, markets expect a cautious trading ahead of the FOMC minutes on Wednesday while looking for earnings reports from Walmart (WMT), Home Depot (HD), Sea Ltd (SE), Agilent (A), Jack Henry (JKHY) and Genius Sports (GENI) as well as the latest numbers on US housing markets and industrial production.

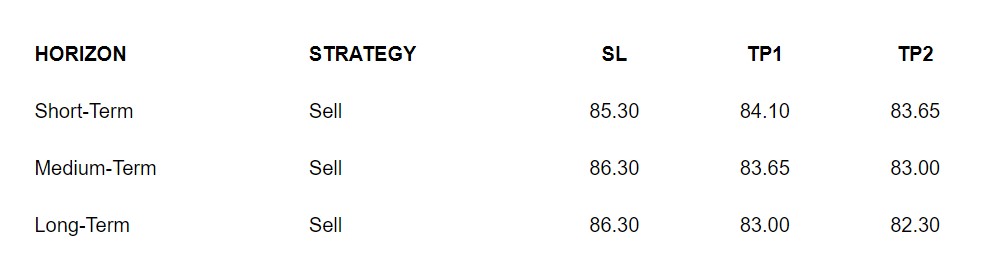

OUR PICK – NZD/JPY

Sour risk sentiments across markets. We see that PBoC move in cutting rates lower signaled that risk sentiments are not favorable right now. A deep plunge into -30 in the Empire State manufacturing index yesterday also does not help an already weary market. We expect Yen shorts continue to be covered and Kiwi is the best candidate to short against Yen given current risk sentiments.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.