Stocks Mixed Amid Rising Yields

MFMTeam

Publish date: Wed, 24 Aug 2022, 09:16 AM

STATE OF THE MARKETS

Stocks mixed amid rising yields. US stocks closed mixed on Tuesday as investors continue to weigh the Federal Reserve decision on rate hikes as economic data came in weaker than expected. Composite PMI came in at 45, its lowest mark since May 2020, vs. 49 expected, while New Home Sales fell to their lowest level since 2016 due to higher mortgage rates.

Dow (-0.47%) fell the most, followed by S&P (-0.22%) while Nasdaq was unchanged and Russell (+0.18%) eked minor gains as yields continued to rise across the board as bonds were sold off. The 10Y benchmark continued to rise past 3.07% as the Dollar index pulled back around the 108.50 mark.

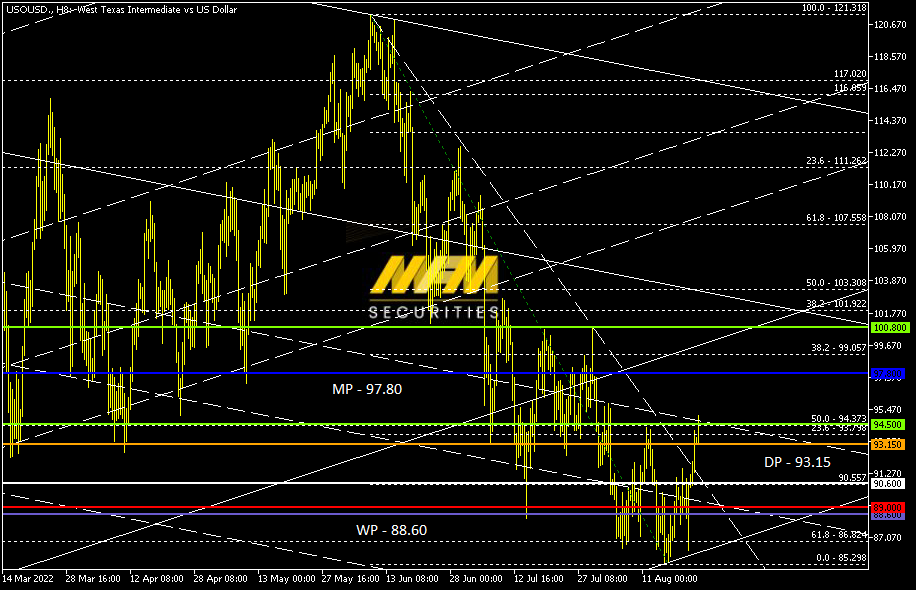

In the commodity markets, crude jumped for the second day after OPEC+ vowed to cut production to cope with surplus as Iran supplies flooded the market. The black gold settled above $93.60/bl as New York closed. Dollar pullback sent gold higher as short sellers started to take profits. The precious metal closed around $1747.90/oz while iron ore was little changed around $105.50/tn as New York closed.

In the FX space, overall sentiment seemed bearish as demand for safe haven Swiss and Yen returned in the long and medium term accounts as more Kiwi and Loonie were sent to offer. Short term traders seemed quick to take advantage of the oversold Yen, Loonie and Sterling as well as the overbought Euro, Kiwi and Dollar.

On Wednesday, markets expect another volatile trading while looking for earnings reports from NVIDIA (NVDA), SalesForce (CRM), Royal Bank of Canada (RY), Snowflake (SNOW), AutoDesk (ADSK), Splunk (SPLK), NetApp (NTAP) and William Sonoma (WSM) as well as the latest numbers on US mortgage application and durable goods orders. EIA petroleum status will be in the spotlight for energy traders.

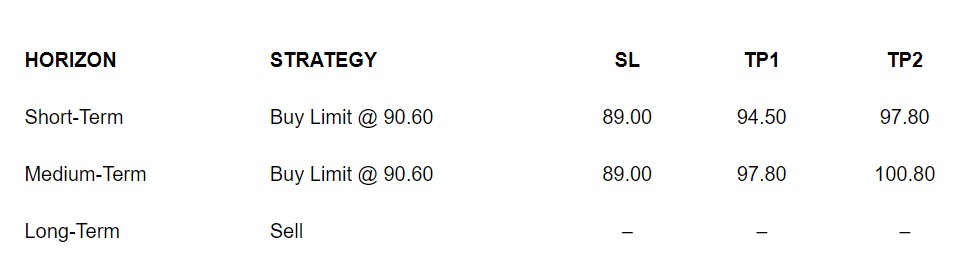

OUR PICK – Crude Oil

OPEC’s willingness to cut production may support crude in the medium term. As Iran continues to work on the nuclear deal and may soon be able to release supplies, Saudi the OPEC leader has vowed to cut production if needed to support price. Long term risk remains to the downside as global recession fears continue to dominate markets.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.