Stocks Drifted Lower Amid Higher Yields

MFMTeam

Publish date: Wed, 07 Sep 2022, 09:17 AM

STATE OF THE MARKETS

Stocks drifted lower amid higher yields. US stocks continue the free fall on Tuesday as investors expect the Federal Reserve to hike another 75 basis points in the coming FOMC meeting in September. Russell (-0.96%) fell the most, followed by Nasdaq (-0.74%), Dow (-0.55%) and S&P (-0.41%) as bonds continue to fall, sending yields higher, with the 10Y benchmark hit 3.35% while the Dollar continue to climb near the 110.80 barrier.

In the commodity markets, global recession fears and Dollar strength continue to weigh on major commodities, with crude oil falling below $86/bl before settling around $86.65/bl as New York closed. Gold jumped to $1726.65/oz but remained under pressure as Dollar strength pulled the precious metal to close below $1,701.85/oz. Elsewhere, iron ore rebounded to $97.50/tn on short covering and profit taking.

In the FX space, King Dollar and Loonie held the helm of demand across all horizons with the Yen being sold off across the board. Sentiments remained mixed with Euro and Swiss in the demand territories while Aussie, Kiwi and Sterling in offers.

On Wednesday, markets may expect another volatile trading while looking for earnings reports from NIO (NIO), Copart (CPRT), Casey General Stores (CASY), GameStop (GME), Descartes Systems (DSGX), Academy Sports & Outdoors (ASO), Verint Systems (VRNT) and American Eagle Outfitters (AEO) as well as the latest numbers on US mortgage application and trade balance. EIA petroleum status will be in the spotlight for energy traders.

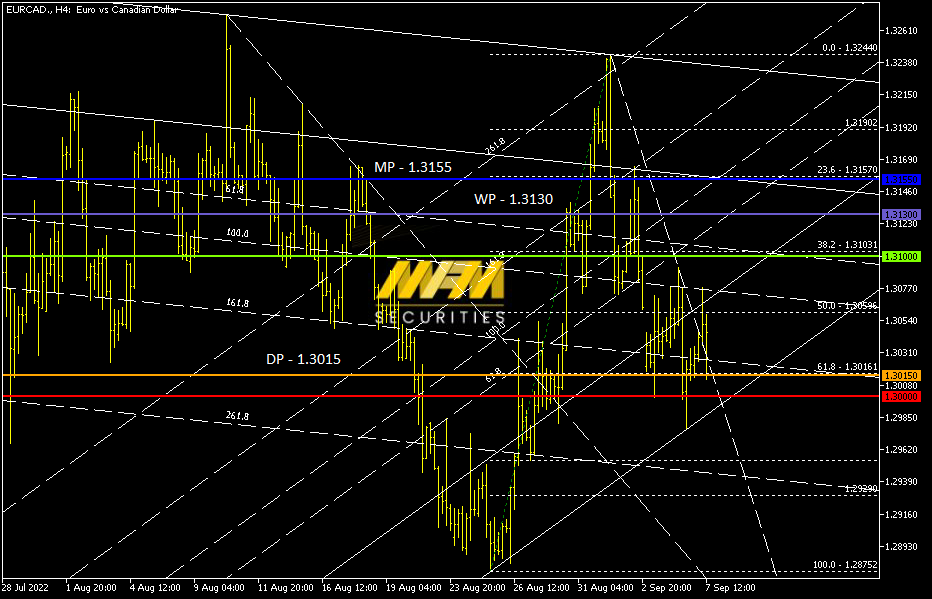

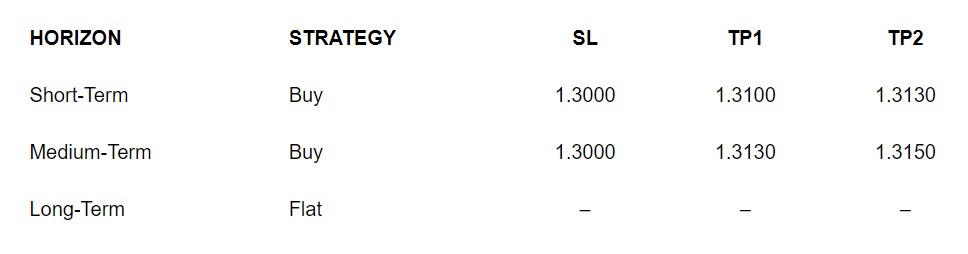

OUR PICK – EUR/CAD

Medium term rebound. We expect profit taking and short covering would continue to send EUR/CAD higher in the medium term amid weaker crude oil that does not bode well for Loonie.

For high probability picks, please use our Trading Central services. You could also join us at MFM’s TradeCopy

Disclaimer: This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.