Stocks Jumped As The Dollar Retreated

MFMTeam

Publish date: Thu, 08 Sep 2022, 09:24 AM

STATE OF THE MARKETS

Stocks jumped as the Dollar retreated. US stocks jumped higher on Wednesday after Fed’s Lael Brainard acknowledged the risk of overtightening even though the Fed is determined to raise rates until inflation is moving down to target. The small cap Russell (+2.21%) jumped the most, followed by Nasdaq (+2.14%), S&P (+1.83%) and Dow (+1.40%) as the Dollar pulled back to test the 109 handle. As at writing, inversion between the shorter term 1Y (3.61%), 2Y (3.44%) and the longer term 5Y (3.36%) and 10Y (3.27%) remained to be seen.

In the commodity markets, crude continued its downward trajectory as global recession fears stoked demand concerns. The black gold settled around $81.50/bl as New York closed. Dollar weakness buoyed gold to close around $1718/oz as heavy flows were noted in gold mining stocks. Elsewhere, iron ore tumbled back to $97.20/tn as downbeat China trade data continue to weigh on the commodity.

In the FX space, sentiments turned bearish as Swiss seized the helm of demand in the short and medium term accounts while Aussie, Loonie and Kiwi pulled back to offers. Long term remained mixed as demand for Swiss remained elevated alongside Dollar and Loonie while Aussie and Kiwi were offered.

On Thursday, markets expect to remain cautious as FedWatch now projects over 80% probability of a 50 to 75 bps hike in September and another 50 bps in November. Earnings and economic data releases to watch includes Zscaler (ZS), DocuSign (DOCU), Bilibili (BILI), RH (RH), Fuelcell Energy (FCEL), Smith & Wesson (SWBI) and American Outdoor (AOUT) as well as the latest US jobless claims and consumer credit.

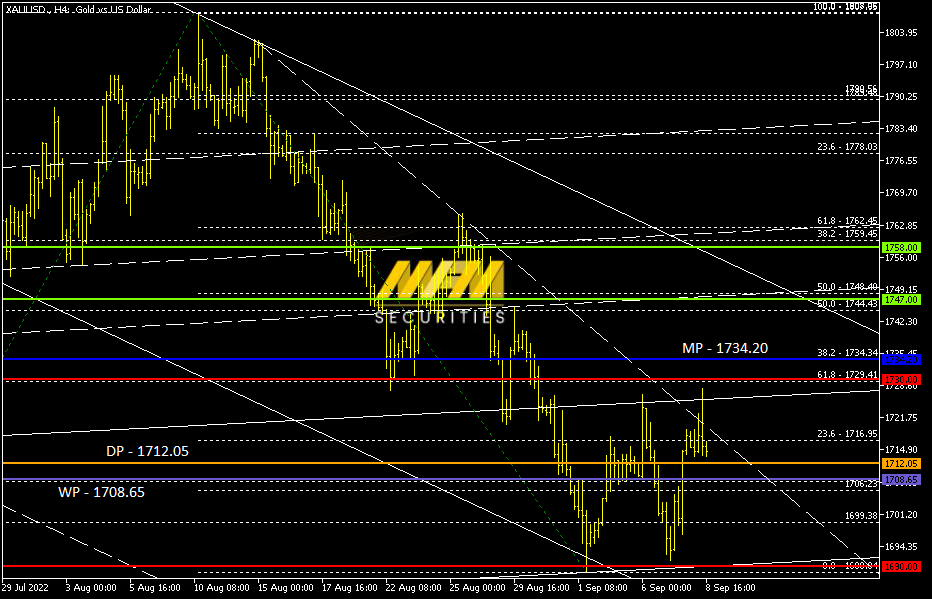

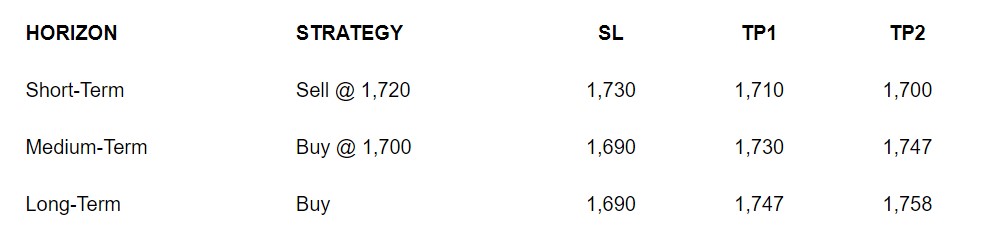

OUR PICK – XAU/USD

Medium to long term rebound. Short term is under pressure but we expect profit taking and short covering would continue to send gold higher in the medium to long term especially after the Fed’s FOMC meeting is over.

For high probability picks, please use our Trading Central services. You could also join us at MFM’s TradeCopy

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.