Dollar Sold Off Ahead of Inflation

MFMTeam

Publish date: Tue, 13 Sep 2022, 09:16 AM

STATE OF THE MARKETS

Dollar sold off ahead of inflation. US stocks continue their upward trajectory as the Dollar was sold off ahead of the inflation report that is expected to slow down. Nasdaq (+1.27%) climbed the most, followed by Russell (+1.23%), S&P (+1.06%) and Dow (+0.71%) as the Dollar index continued its free fall to the 108 handle. As at writing, yields inversion remained to be seen between the short term 1Y (3.67%), 2Y (3.57%) and the long term 5Y (3.46%), 10Y (3.36%) and 30Y (3.51%).

In the commodity markets, Dollar weakness continues to float major commodities, with crude oil continuing to climb for the third day in a row. The black gold settled around $87.70/bl as New York closed. Similarly, gold rebounded higher to $1,735/oz and iron ore regained the $101/tn handle.

In the FX space, sentiments seemed bearish as the safe haven Swiss seized the helm of demand across all horizons while King Dollar retreated in the long term accounts. Short and medium term accounts demand more Euro, Sterling and Aussie while keeping Dollar, Kiwi and Loonie on offers.

On Tuesday, markets may expect another volatile trading if inflation is disappointing though traders may be selling the news. Earnings reports to watch for include Core & Main (CNM) and Iris Energy (IREN) as well as the latest numbers on US inflation and small business optimism index.

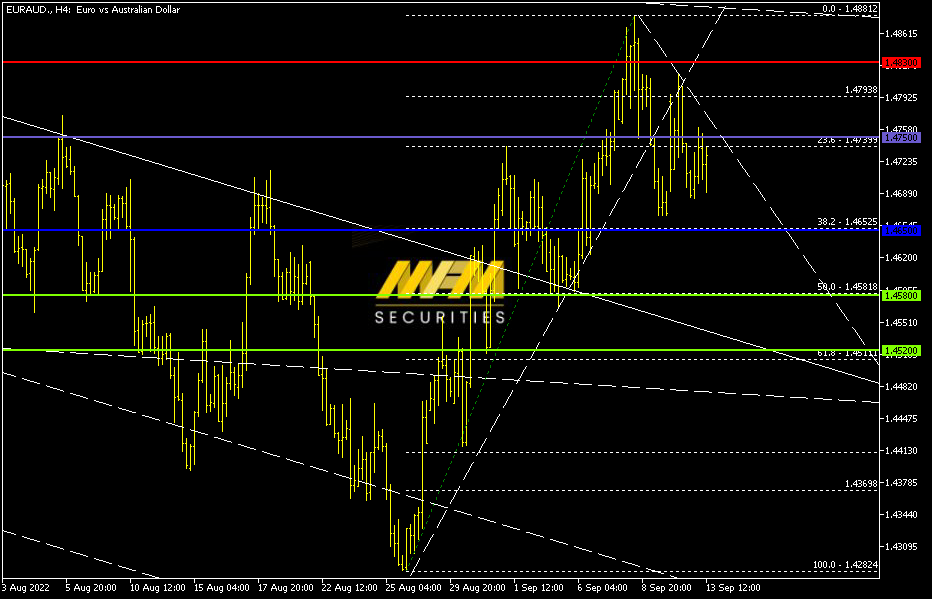

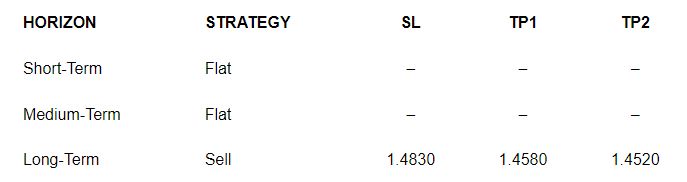

OUR PICK – EUR/AUD

Long term remained bearish. We see Dollar weakness helped buoy other currencies especially Euro, Sterling and Aussie. EUR/AUD may be in for a turnaround, hence the short and medium term rebound, but long term remains bearish in our view.

For high probability picks, please use our Trading Central services. You could also join us at MFM’s TradeCopy

Disclaimer: This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.