Stocks Sink On Inflation Shock

MFMTeam

Publish date: Wed, 14 Sep 2022, 09:29 AM

STATE OF THE MARKETS

Stocks sink on inflation shock. US stocks sank on Tuesday after reports of higher than expected inflation, prompting markets to pullback on bullish bets. The tech-laden Nasdaq (-5.16%) fell the most, followed by S&P (-4.32%), Dow (-3.94%) and Russell (-3.91%) as the Dollar index jumped back to the 110 handle. As at writing, yields jumped as bonds were sold off while inversion remained to be seen between the short term 1Y (3.95%), 2Y (3.78%) and the long term 5Y (3.61%), 10Y (3.43%) and 30Y (3.51%).

In the commodity markets, Dollar strength pulled back major commodities lower with crude dropping to $84.67/bl before settling around $87.15/bl as New York closed. Gold dropped near the $1,700/oz major handle as the non-interest bearing assets struggled to find bids in rising yields. Elsewhere, iron ore however remained stalled around $101.40/tn waiting for the next catalysts.

In the FX space, King Dollar returned to the helm of demand in the short and long term while advanced into the demand territories in the medium term. Swiss, Euro and Sterling however, still led the demand.

On Wednesday, markets expect cautious trading in a thin earnings calendar with eyes on the producer price index to see if inflation is sticky. Earnings to watch include BRP Inc (DOOO) and RF Industries (RFIL). EIA petroleum status will be in the spotlight for energy traders.

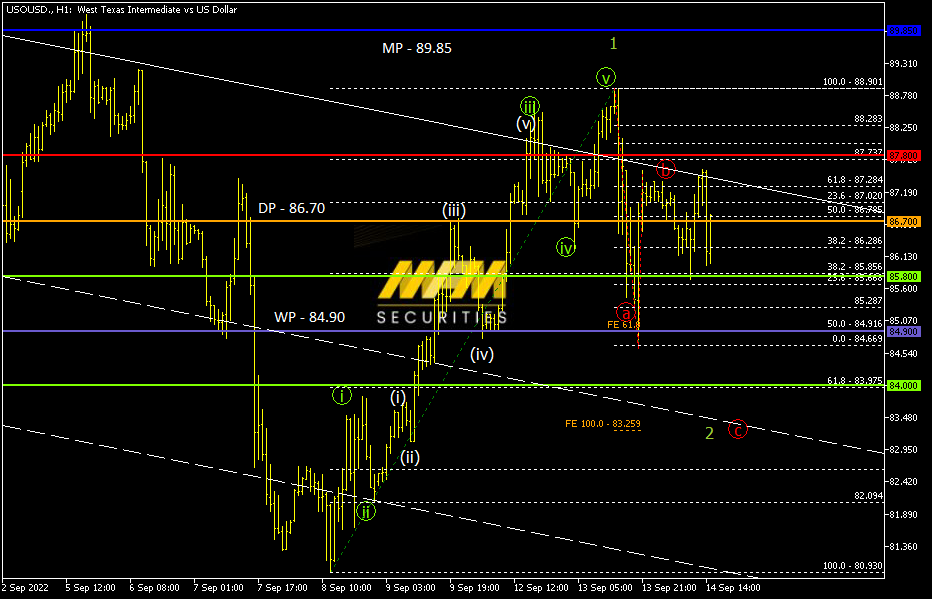

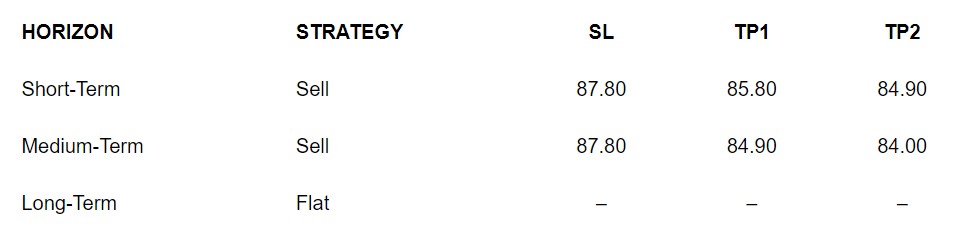

OUR PICK – Crude Oil

Short to medium term pullback. Elliot wave seemed to suggest an upward motive is completed and now on short to medium term pullback. As markets expect at least another 75 basis points hike next week, Dollar strength is expected to return especially after the upbeat inflation report yesterday. PPI today may strengthen the case for a higher rate.

For high probability picks, please use our Trading Central services. You could also join us at MFM’s TradeCopy

Disclaimer: This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.