Dow Enters Bear Market, S&P Hits New Low

MFMTeam

Publish date: Tue, 27 Sep 2022, 09:21 AM

STATE OF THE MARKETS

Dow enters bear market, S&P hits new low. US stocks tumbled further on Monday as investors continue to weigh Fed’s rate hikes in the coming months to battle inflation. The blue chip Dow (-1.11%) finally fell 20% from its peak in January while the S&P (-1.03%) hit a new low for the year. The S&P has been in a bear market since June while the tech-laden Nasdaq (-0.60%) in March.

Stocks liquidation and Dollar demand amid rising yields has sent the Dollar index past the 113.50 mark – the highest in 20 years. In the bond market, yields for 1Y (4.16%), 2Y (4.29%), 5Y (4.11%) including 7Y (4.02%) has surpassed 4% while the 10Y (3.85%) benchmark and the 30Y (3.70%) remained under.

In the commodity markets, Dollar strength and demand concerns amid global recession fears continue to weigh on crude oil as the black gold drifted lower near $76/bl. Non-interest bearing gold continued to lose bidders and settled below $1,625/oz as New York closed. Elsewhere, iron ore rebounded to $99/tn as short-covering and profit taking continue to lift the commodity.

In the FX space, sentiments are more bearish as long term accounts demand more Yen and sell Aussie, Kiwi and Sterling. Dollar, Yen and Swiss continue to lead in the demand territories. Short term traders were quick to bid the oversold Sterling while dumping Loonie and Yen.

On Tuesday, markets expect more cautious trading and ready to sell on rally as VIX looks poised to shoot north. Earnings reports to watch for include TD Synnex (SNX), Jabil (JBL), Endava (DAVA), Neogen (NEOG), BlackBerry (BB), Cal-Maine Foods (CALM), United Natural Foods (UNFI), Cracker Barrel (CBRL) and Progress Software (PRGS) as well as the latest numbers on US new home sales, home price index, durable good orders, consumer confidence and manufacturing index.

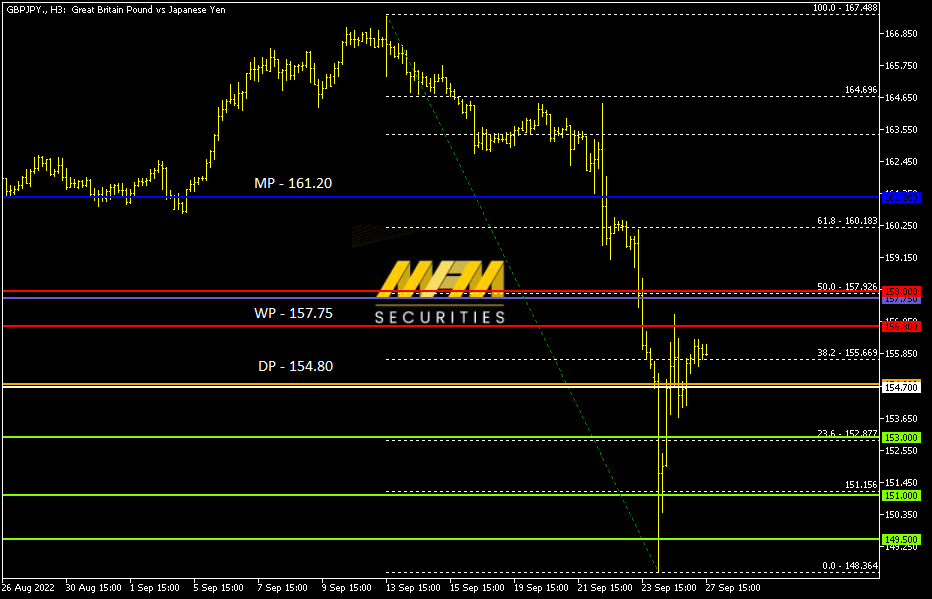

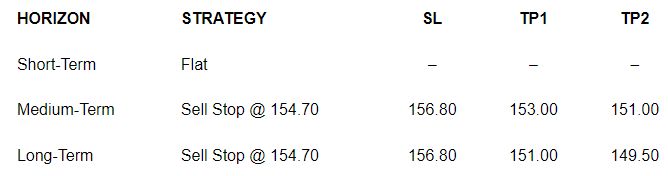

OUR PICK – GBP/JPY

Medium to long term weakness. We see medium to long term weakness in Sterling as markets react to recent UK tax cuts coupled with the energy crisis in the coming winter. We prefer sell stops though aggressive traders may enter at the market with stops above the 158 handle. Further rebound in the short term could not be ruled out.

For high probability picks, please use our Trading Central services. You could also join us at MFM’s TradeCopy

Disclaimer: This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.