Stocks Mixed Amid Rising Dollar

MFMTeam

Publish date: Wed, 28 Sep 2022, 09:27 AM

STATE OF THE MARKETS

Stocks mixed amid rising Dollar. US stocks closed mixed on Tuesday after investors stepped in to bid oversold tech and small cap growth despite statements from a few Fed’s official that they would not stop raising rates until inflation is tamed. Nasdaq (+0.25%) and Russell (+0.40%) closed in the green while Dow (-0.43%) and S&P (-0.21%) tumbled further as the Dollar index continued to rise past the 114.50 minor handle in early Asian trading. The 10Y benchmark nearly crossed 4% before ending around 3.98% as investors took advantage of higher yields to reduce risk in equities.

In the commodity markets, crude rebounded and closed above $77.70/bl after reports of supply disruption amid hurricane Ian on the east coast. Gold was on strong bids after news of Nordstrom explosion that could lead to further escalation of the Russia-Ukraine war. The precious metal settled above $1,620.70/oz as New York closed. Elsewhere, iron ore continues to drift lower to $98.80/tn as Dollar strength continues to weigh on the commodity.

In the FX space, overall sentiments remained bearish as King Dollar, Swiss and Yen continue to lead the demand across all horizons while Aussie and Kiwi continue to be sold alongside Sterling.

On Wednesday, markets expect cautious trading and more demand for bonds is expected as yields past the 4% mark. Earnings to watch include Paychex (PAYX), Cintas Corp (CTAS), Vail Resorts (MTN), Jefferies Financial (JEF), Concentrix Corp (CNCX) and Thor Industries (THO). EIA petroleum status will be in the spotlight for energy traders.

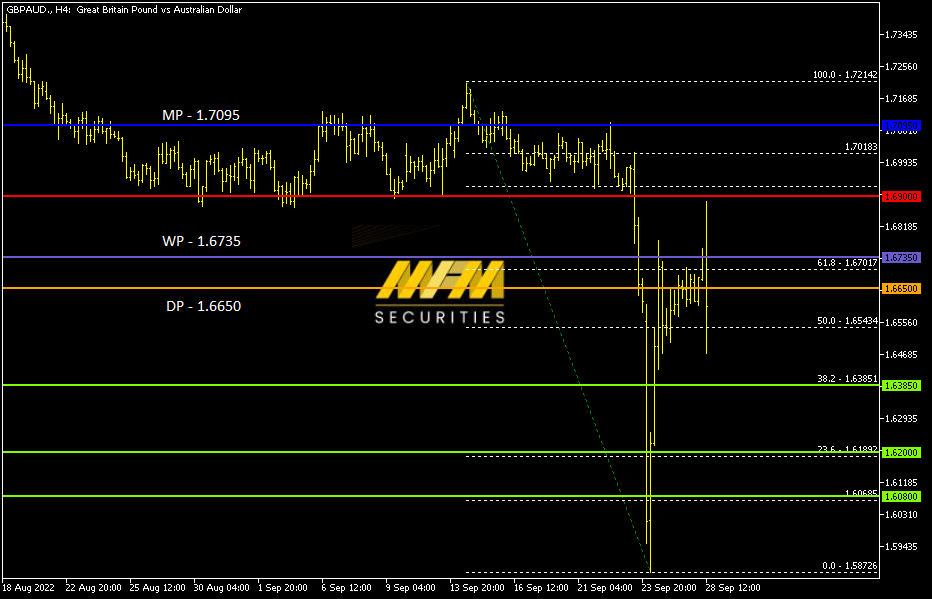

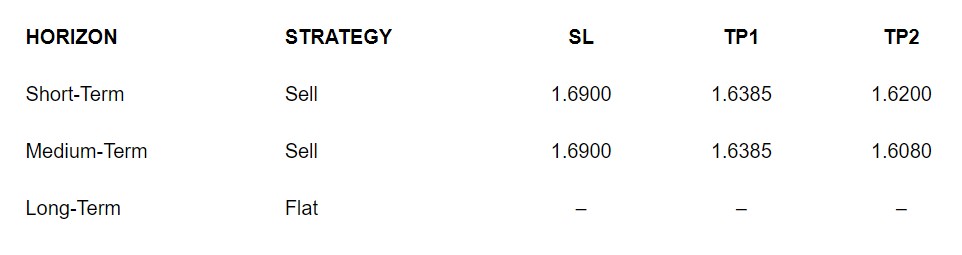

OUR PICK – GBP/AUD

Short to medium term weakness. We see short to medium term weakness in Sterling to continue despite Bank of England’s efforts to step in and buy bonds and calm markets especially against higher yielding beta like the Aussie and Kiwi. However, the risk of turning around could not be ruled out.

For high probability picks, please use our Trading Central services. You could also join us at MFM’s TradeCopy

Disclaimer: This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.