Stocks Surged Further Amid Bonds & Dollar Pullback

MFMTeam

Publish date: Wed, 05 Oct 2022, 09:42 AM

STATE OF THE MARKETS

Stocks surged further amid bonds and Dollar pullback. US stocks and bonds rose further on Tuesday after reports of stable factory orders but less than expected job openings in August. The small-cap Russell (+3.91%) jumped the most, followed by Nasdaq (+3.34%), S&P (+3.06%) and Dow (+2.80%) as the Dollar fell near the 110 handle before bidders emerged to bid the greenback. Sentiments seemed to be taking a turn as bonds lost bids, sending yields higher, with the 10Y benchmark back around 3.7% as at writing.

In the commodity markets, crude continues its upward trajectory ahead of the OPEC+ meeting that is ready to cut production to sustain higher prices. The black gold settled around $85.70/bl as New York closed. Fed’s note of lower expected inflation that would slow rate hikes and escalating tension in the sino-pacific rim helped gold to climb higher and settled near $1725.90/oz. Elsewhere, Dollar weakness buoyed iron ore to $95.20/tn, $1 higher than the day before.

In the FX space, demand for long and medium accounts remained unchanged while short term traders were quick to flip Swiss back to demand while Kiwi and Loonie were flipped to offer. Euro advanced further to take the lead in demand alongside Sterling and Yen.

On Wednesday, markets expect a more volatile session as the ADP employment reports may shed light on the Fed’s effectiveness in controlling inflation. Earnings to watch include RPM International (RPM), Lamb Weston (LW), Helen of Troy (HELE) and Resources Connection (RGP) as well as the latest figures in mortgage applications, ADP employment and PMIs. EIA petroleum status will be in the spotlight for energy traders.

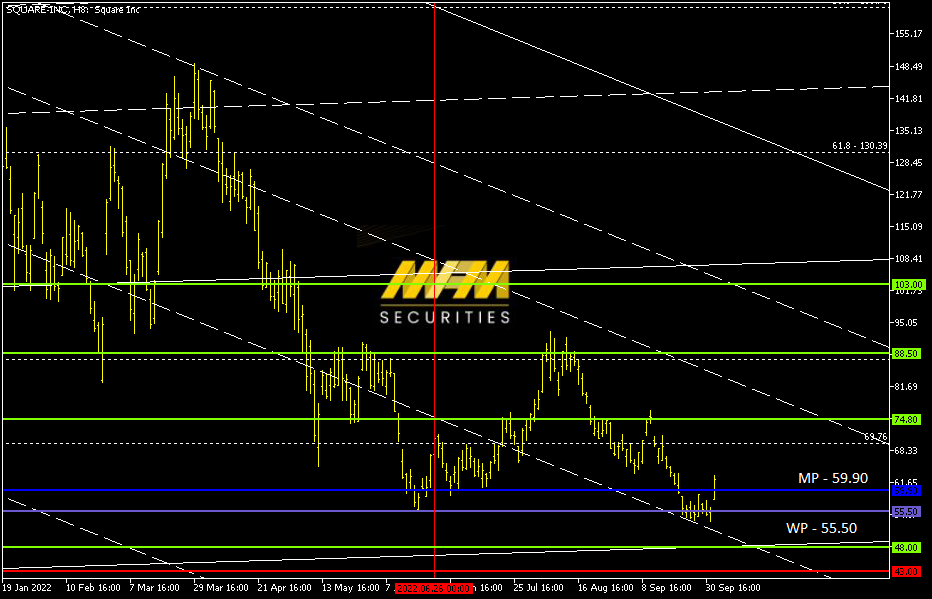

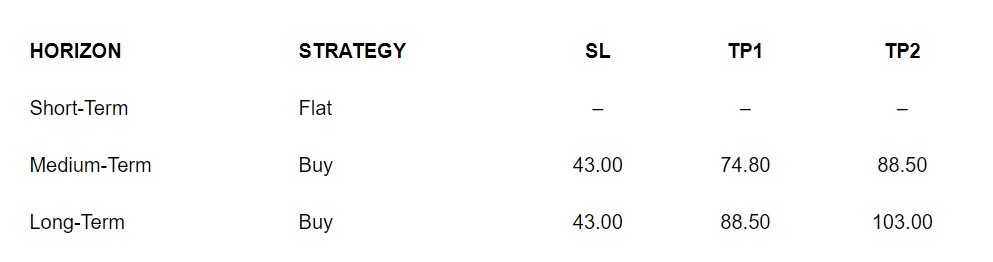

OUR PICK – Block Inc (SQ, NYSE)

The leader in digital banking. Once called Square, the company is a technology platform that facilitates payments and point of sales for merchants and retail banking through its cash app. Recent stock rout didn’t exclude SQ and the share is at a long term uptrend line. Recent surge in block orders signaled that the bottom is near as price is flirting with confluence in the monthly, weekly and daily pivot; though further drop to $48 could not be ruled out. We see medium to long term upside as long as $48 remains intact with $43 as a hard stop.

For high probability picks, please use our Trading Central services. You could also join us at MFM’s TradeCopy

Disclaimer: This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.