Stocks Rallied As Q3 Earnings Kicked In

MFMTeam

Publish date: Tue, 18 Oct 2022, 09:17 AM

STATE OF THE MARKETS

Stocks rallied as Q3 earnings kicked in. US stocks staged a relief rally on Monday after few banks delivered solid earnings for Q3 and a drop in the manufacturing index dimmed the chance of a 75 basis points hike in December. Nasdaq (+3.43%) climbed the most, followed by Russell (+3.17%), S&P (+2.65%) and Dow (+1.86%) as the Dollar index pulled back below the 112.20 barrier. Bonds were sold-off, sending yields higher, with the 10Y benchmark back flirting above the 4% mark.

In the commodity markets, crude was in choppy trading as investors continue to weigh the impact of high inflation and energy demand amid global recession fears. The black gold was little changed around the $84.70/bl. Similar fate engulfed gold too but Dollar weakness continued to buoy the precious metal above the $1,640 handle. Elsewhere, iron ore continues to drift lower as choked demand continues to press the commodity below the $95/tn mark.

In the FX space, overall sentiments seemed bullish as Kiwi seized the helm of demand in the short and medium term while the safe haven Dollar and Yen were sold-off. Swiss was seen synching across all horizons, signaling that a change in sentiments might be around the corner.

On Tuesday, markets may expect the rally to continue as more earnings were released from the giants like Johnson & Johnson (JNJ), Netflix (NFLX), Lockheed Martin (LMT) and Goldman Sachs (GS). Investors also look ahead to the release of industrial production data and home builders index to gauge the health of the US economy.

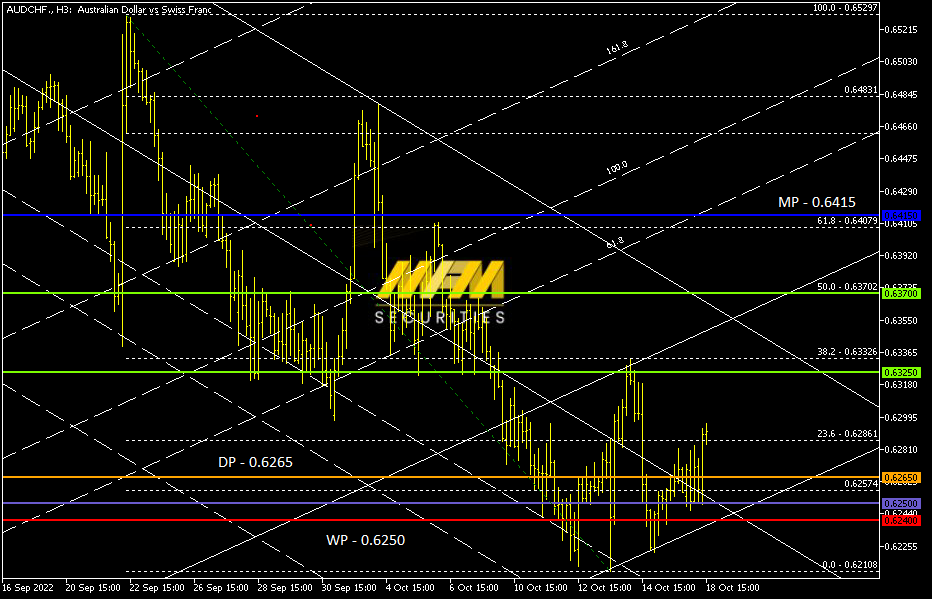

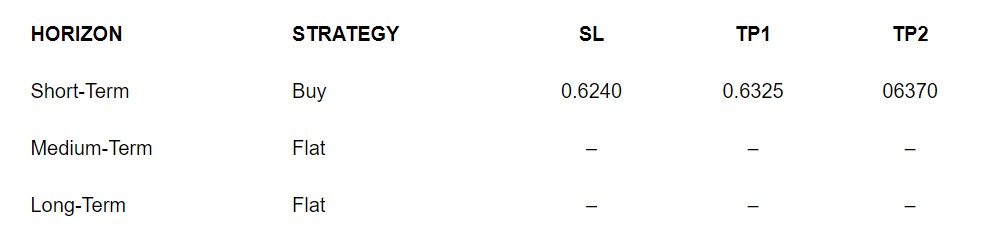

OUR PICK – AUD/CHF

Improved sentiments may float Aussie further. Our sentiments model signaled a bullish Aussie/Swiss in the short term that medium and long term sentiments may pick up if markets continue to be bullish.

For high probability picks, please use our Trading Central services. You could also join us at MFM’s TradeCopy

Disclaimer: This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.