Relief Rally Continues

MFMTeam

Publish date: Wed, 19 Oct 2022, 09:57 AM

STATE OF THE MARKETS

Relief rally continues. US stocks jumped higher on Tuesday before pulling back after a series of upbeat earnings from Goldman Sachs (GS), Lockheed Martin (LMT) and others, though economic data was mixed. Russell (+1.16%) gained the most, followed by S&P (+1.14%), Dow (+1.12%) and Nasdaq (+0.90%) as the Dollar index was pushed lower below the 112 handle. Bonds were mostly sold-off, sending yields higher, with the 10Y benchmark breaking 4.10% as at writing, the highest since October 2008.

In the commodity markets, crude continued its downward trajectory amid global recession fears. The black gold dipped to the low of $81.25/bl before bidders emerged to settle the commodity around $82.85/bl as New York closed. Gold edged higher to $1,660.75/oz before sellers continue to push the metal lower after investors see higher rate hikes coming in November and December.

In the FX space, bullish sentiments continued as Swiss pulled back further into the offered territories, though Yen gained in the short-term accounts. Short-term traders were seen bidding more Kiwi, Dollar and Aussie while offering Euro, Swiss and Sterling. Demand for Sterling, Kiwi and Euro remained elevated in the medium term accounts.

On Wednesday, markets expect to be cautious after Goldman Sachs (GS) commented that they see rates moving higher and sticky inflation ahead but any upbeat earnings from tech heavyweight would send stocks higher in the near term. Earnings to watch include Tesla (TSLA), Procter & Gamble (PG), Abbott Lab (ABT), ASML Holdings (ASML), Elegance Health (ELV), IBM (IBM), Crown Castle (CCI), Lam Research (LRCX) and Kinder Morgan (KMI) as well as the latest figures in the US mortgage applications, housing starts and permits. EIA petroleum status will be in the spotlight for energy traders.

OUR PICK – GBP/CAD

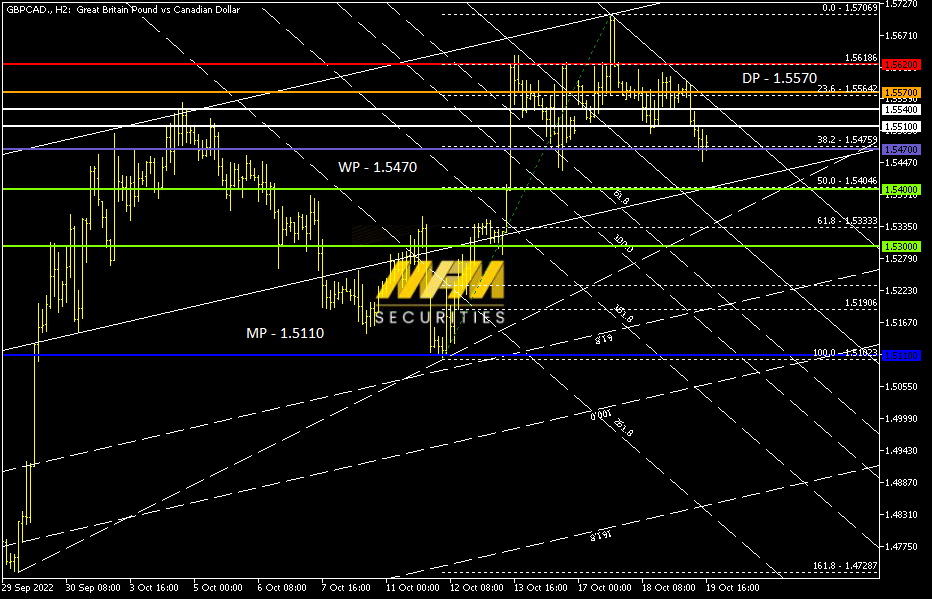

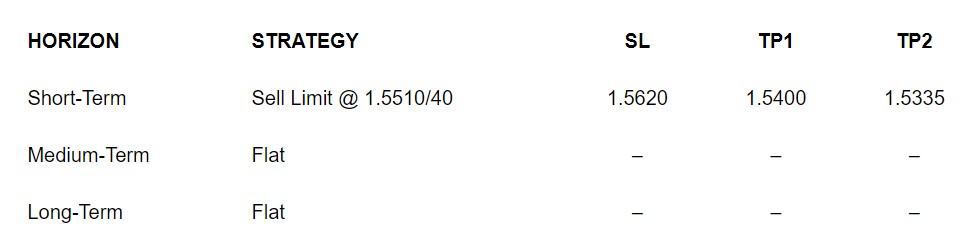

Short term weakness. Our sentiment model indicates a short term downside for Sterling especially against the commodity currencies as sentiments improved. Any sudden shift in sentiments, however, may see a spike to the upside. We prefer to sell on limit around 1.5510-40 but a close above the daily pivot, circa 1.5570, may prompt an early exit.

For high probability picks, please use our Trading Central services. You could also join us at MFM’s TradeCopy