Stocks Sank, Dollar Rose As Election Closed

MFMTeam

Publish date: Thu, 10 Nov 2022, 09:13 AM

STATE OF THE MARKETS

Stocks sank, Dollar rose as election closed. US stocks sank on Wednesday after news hit the wires that the red wave failed to capture Congress to limit tax and spending plans that would have secured year end rally. The small cap Russell (-2.68%) fell the most, followed by Nasdaq (-2.48%), S&P (-2.08%) and Dow (-1.95%) as investors fled to bond safety that sent yields higher across the board. The 10Y benchmark fell to 4.10% while the shorter 2Y fell to 4.58% as the Dollar index jumped back above the 110.50 minor handle.

In the commodity markets, food commodities continue to receive heavy flows as a sign of risk aversion while crude oil tumbled below $85/bl as demand concerns continue to plague global markets. Gold was little changed but remained well bid above the $1700/oz handle as investors continue to bid for capital protection. Elsewhere, iron ore continues to climb above $87.50/tn as markets continue to brace for China’s new Covid exit policy.

In the FX space, sentiments were mixed with Dollar, Swiss and Yen remained well bid in the short and medium term accounts while offered in the long term accounts. Aussie and Kiwi continued to be offered in the short and medium term accounts, though Loonie remained bid.

On Thursday, markets expect to remain volatile as investors brace for the latest release of inflation figures. Expectations are set at +6.5% YoY and CME FedWatch projects a 52% probability of a 50 points hike in December. Anything above 6.5% inflation could push yields higher and stocks lower. Earnings to watch include AstraZeneca (AZN), Brookfield Asset Management (BAM), Becton Dickinson (BDX), ArcelorMittal (MT) and NIO (NIO) as well as jobless claims and inflation figures.

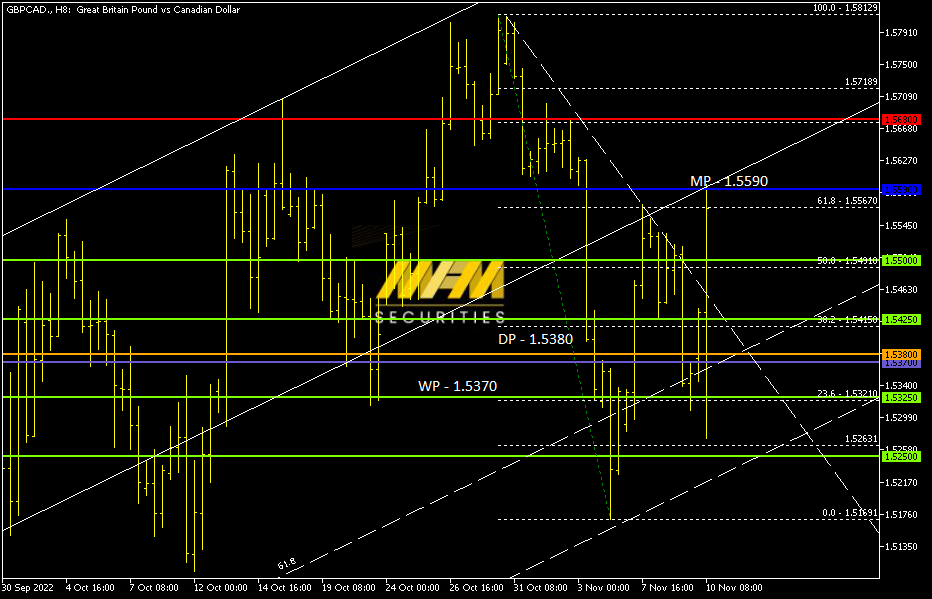

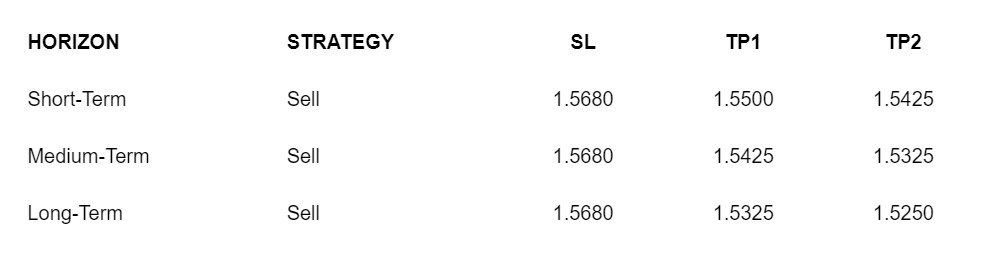

OUR PICK – GBP/CAD

We expect CAD resilience to continue against Sterling. Our sentiment model indicates that the recent jump was a mere bounce in picking up unfilled orders from last week’s breakout area circa 1.5550/80. We expect the monthly pivot to hold and selling pressure to resume in the next few days.

For high probability picks, please use our Trading Central services. You could also join us at MFM’s TradeCopy

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.