Dollar Steady On Flight To Safety

MFMTeam

Publish date: Thu, 08 Dec 2022, 08:28 AM

STATE OF THE MARKETS

Dollar steady on flight to safety. While US stocks continued to drift lower on Wednesday, the Dollar index held steady above the 105 handle as demand for bond’s safety sent yields lower across the board. Except for Dow that was unchanged, Nasdaq (-0.51%), Russell (-0.31%) and S&P (-0.19%) all edged lower as recession fears continue to weigh on equities. The 2Y note yields fell to 4.26% while the 10Y benchmark dropped to 3.42% as investors continue to flock to the bond markets.

In the commodity markets, recession fears continue to push crude oil lower and the black gold dropped to $72.60/bl as at writing. Flight to safety benefits gold as investors see the precious metal to hold above the $1,780/oz barrier. Huge interest was reported in the yellow metal after news of record buying by central banks last month. Elsewhere, the bearish sentiments pushed iron ore lower, near $107.10/tn, as demand concerns continue to plague the commodity markets.

In the FX space, Kiwi reigned in demand across all horizons as Loonie was sold-off alongside King Dollar and Aussie in the long and medium term. Demand for safe-haven Swiss eased while Sterling and Euro returned alongside Yen in the long and medium term. Sentiments were mixed.

On Thursday, markets may turned choppy as long term investors look to cash out on further rally in equities while short term traders may look to scoop some bargains as more earnings reports roll in. Earnings releases to watch includes Broadcom (AVGO), Costco Wholesale (COST), Lululemon (LULU), Chewy (CHWY), Cooper Companies (COO), DocuSign (DOCU), Ciena Corp (CIEN) and Manchester United (MANU) as well as the latest figures in the US jobless claims.

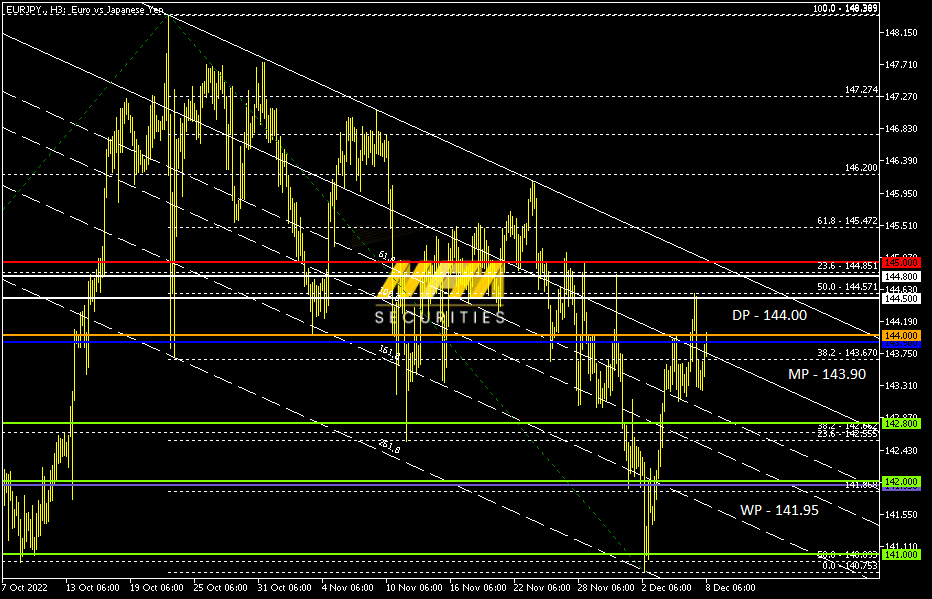

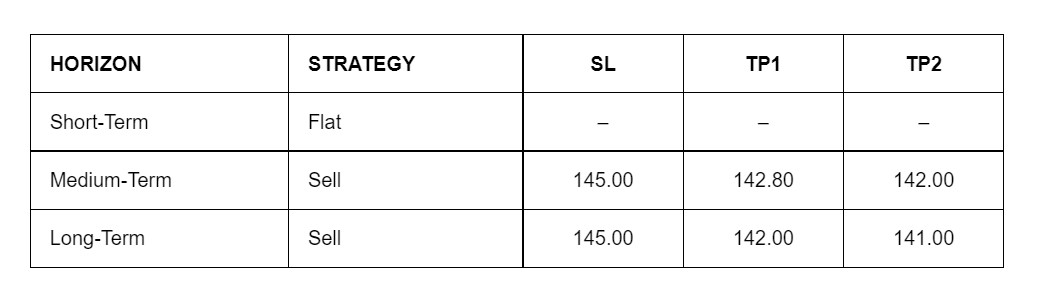

OUR PICK – EUR/JPY

Long term remained under pressure. Recent rebound on profit taking sent the pair higher but long term sentiments remained bearish. Further short term rebound to 144.50/80 could not be ruled out but would be the best entry to short as we expect long term sentiments to resume.

For high probability picks, please use our Trading Central services. You could also join us at MFM’s TradeCopy

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.